Venture Capital

8 Slides

8 Slides

File size: 16:9

File size: 16:9

Fonts: Lato Black, Calibri

Fonts: Lato Black, Calibri

Supported version

PPT 2010, PPT 2013, PPT 2016

Supported version

PPT 2010, PPT 2013, PPT 2016

Product details

Venture capital is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions. Venture capital is typically allocated to small companies with exceptional growth potential, or to companies that have grown quickly and appear poised to continue to expand.

Though it can be risky for investors who put up funds, the potential for above-average returns is an attractive payoff. For new companies or ventures that have a limited operating history, venture capital is increasingly becoming a popular source for raising money, especially if they lack access to capital markets, bank loans, or other debt instruments. The main downside is that the investors usually get equity in the company, and, thus, a say in company decisions.

In a venture capital deal, large ownership chunks of a company are created and sold to a few investors through independent limited partnerships that are established by venture capital firms. Sometimes these partnerships consist of a pool of several similar enterprises.

One important difference between venture capital and other private equity deals, however, is that venture capital tends to focus on emerging companies seeking substantial funds for the first time, while private equity tends to fund larger, more established companies.

For small businesses, or for up-and-coming businesses in emerging industries, venture capital is generally provided by high net worth individuals —also often known as angel investors.

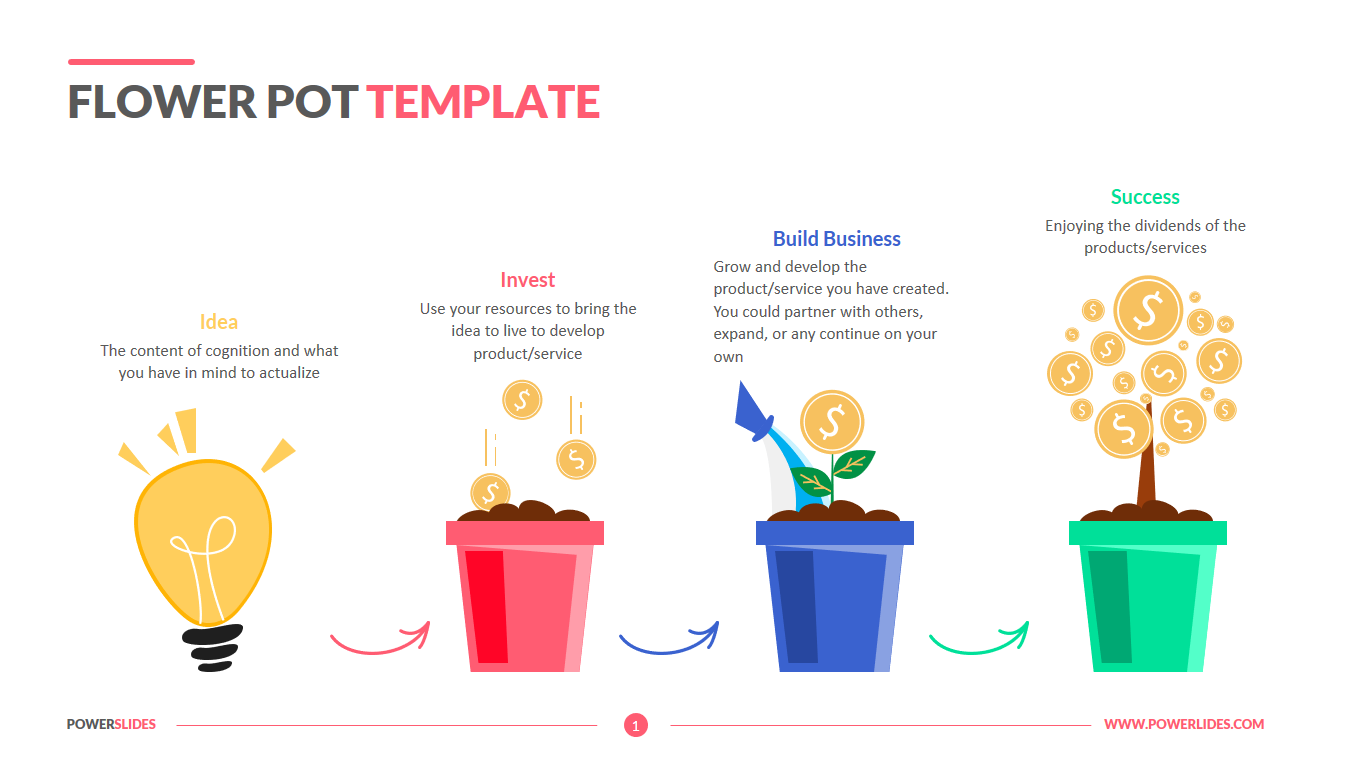

Innovation and entrepreneurship are the kernels of a capitalist economy. New businesses, however, are often highly-risky and cost-intensive ventures. As a result, external capital is often sought to spread the risk of failure. In return for taking on this risk through investment, investors in new companies are able to obtain equity and voting rights for cents on the potential dollar. Venture capital, therefore, allows startups to get off the ground and founders to fulfill their vision.

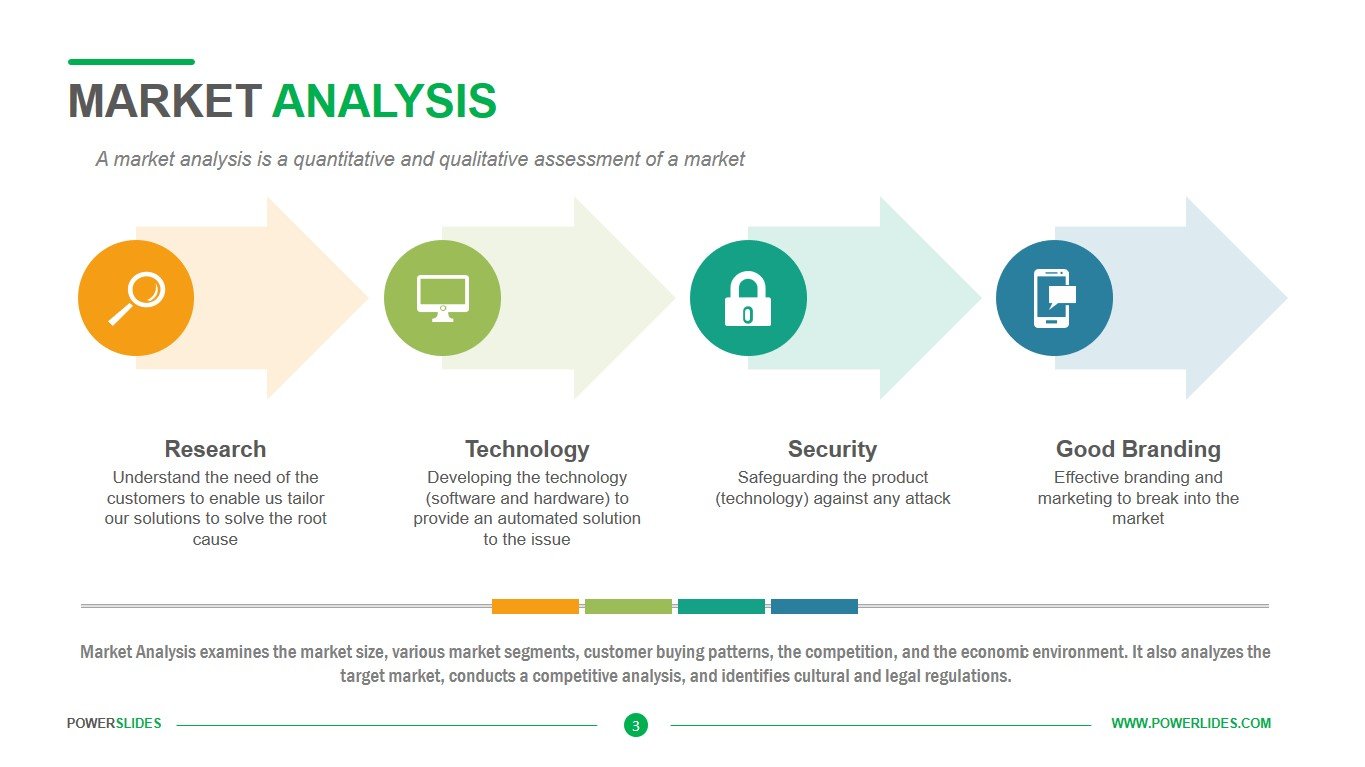

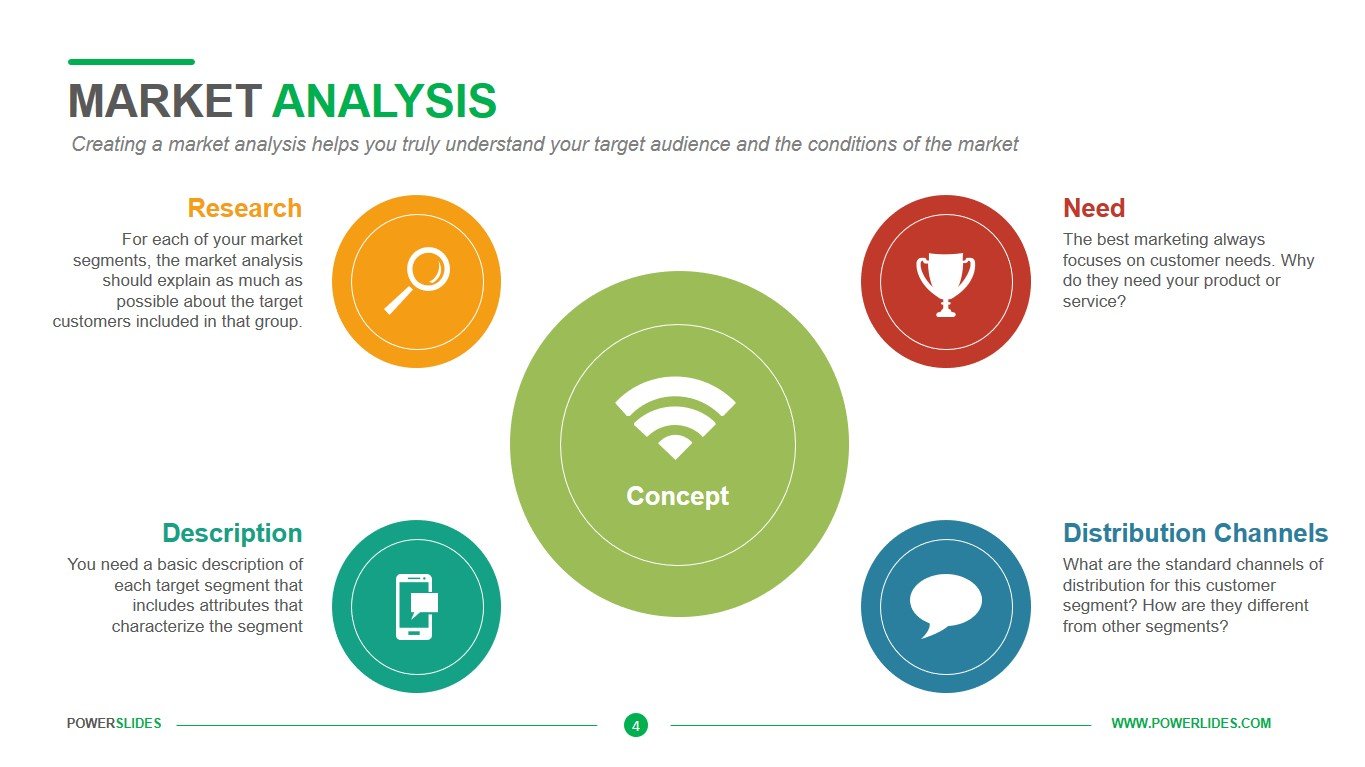

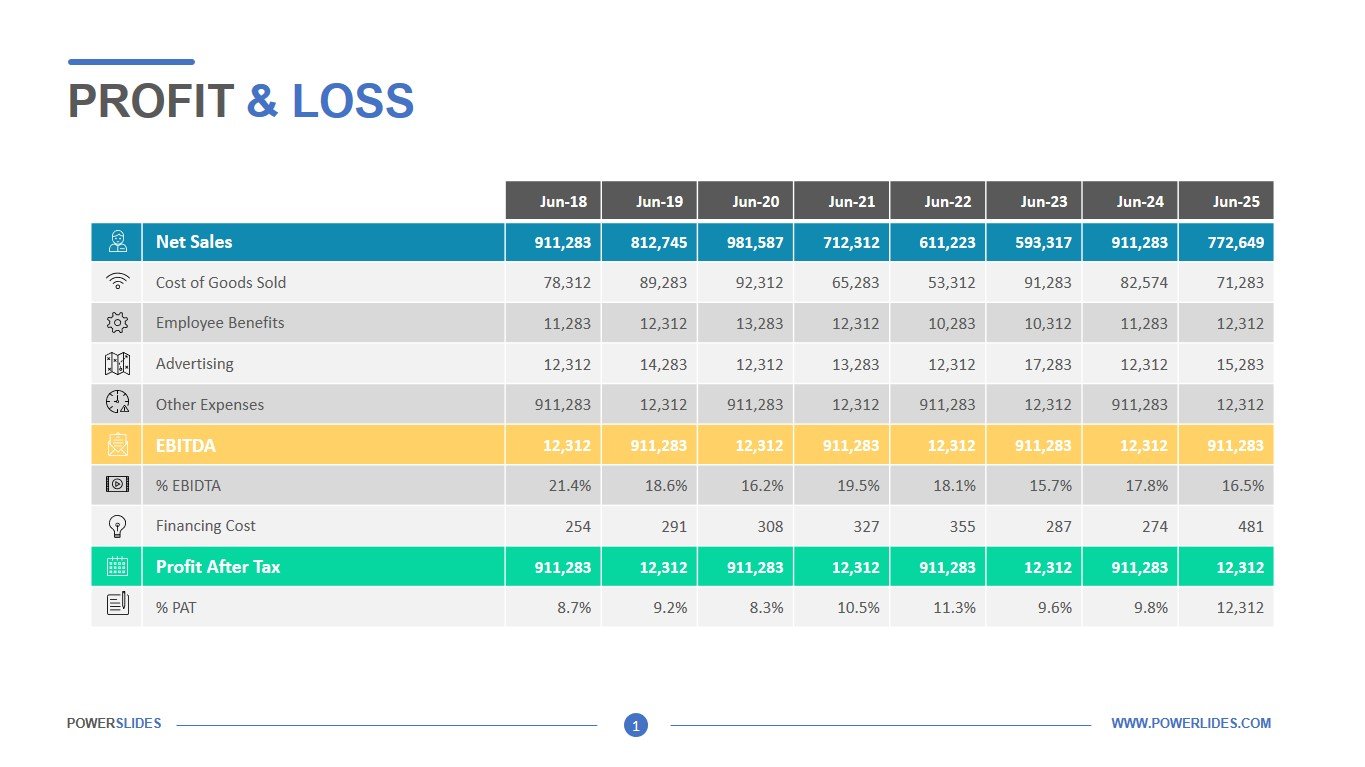

The slides of this template can be used by economists and financiers in their day-to-day work. You can prepare information about the company’s profit when investing in various venture capital funds or startups. Crisis managers can use this template when preparing a strategy for getting a company out of losses. For example, you can provide information on the required borrowed funds and how to obtain them.

Business coaches can use the slides from this template when preparing their courses on money management or investing in innovative technologies. Government officials who support small businesses can use this template to prepare courses to train young entrepreneurs. You can explain in detail how Venture Capital differs from other types of borrowed funds.

Venture Capital is a stylish and professional template that consists of 8 slides, each with infographics and graphs. All slides in the template can be easily customized to suit your corporate color requirements. Venture Capital The template will be useful for financiers, bank workers, investment funds and startups. This template will update your old presentations and seamlessly complement your collection of professional templates.

(4.67/ 5)

(4.67/ 5)