Audit Risk Model

4 Slides

4 Slides

File size: 16:9

File size: 16:9

Fonts: Lato Black, Calibri

Fonts: Lato Black, Calibri

Supported version

PPT 2010, PPT 2013, PPT 2016

Supported version

PPT 2010, PPT 2013, PPT 2016

Product details

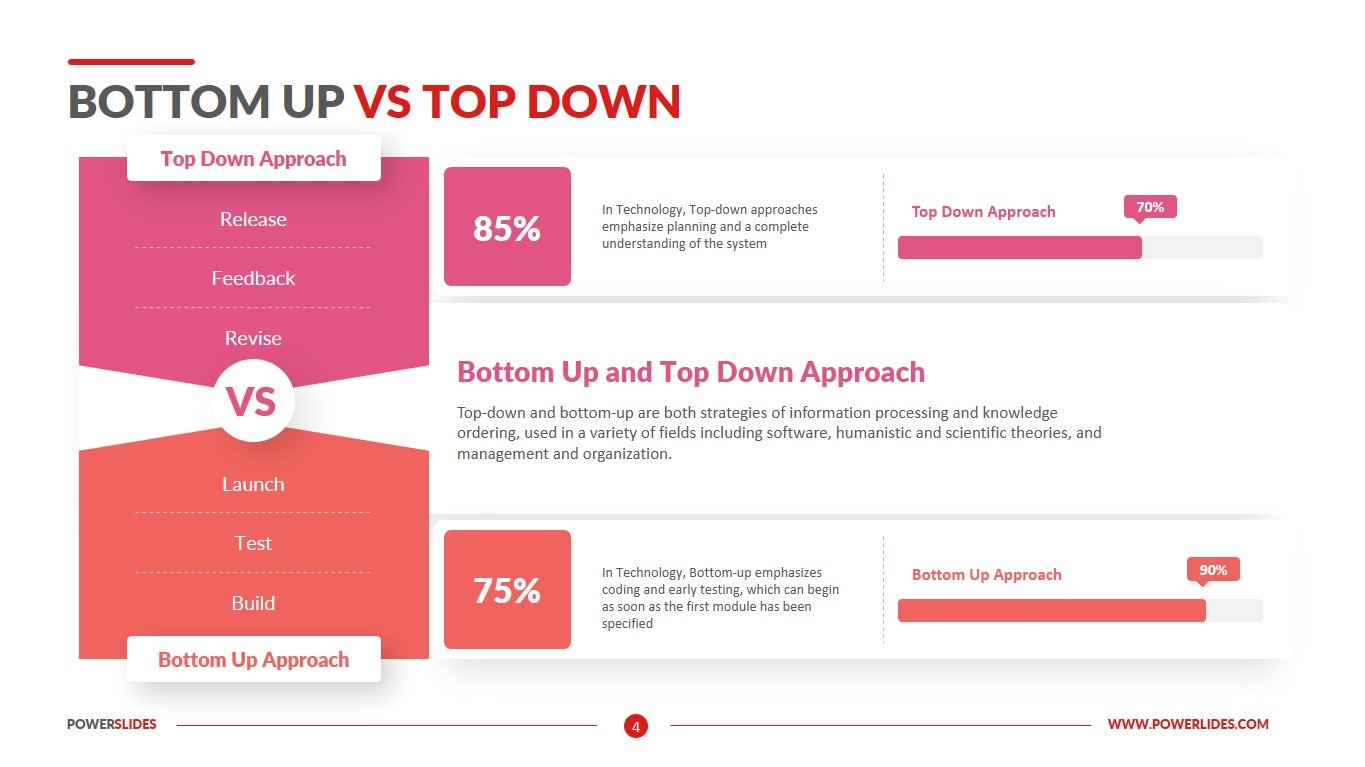

An audit risk model is a conceptual tool applied by auditors to evaluate and manage the various risks arising from performing an audit engagement. The tool helps the auditor decide on the types of evidence and how much is needed for each relevant assertion.

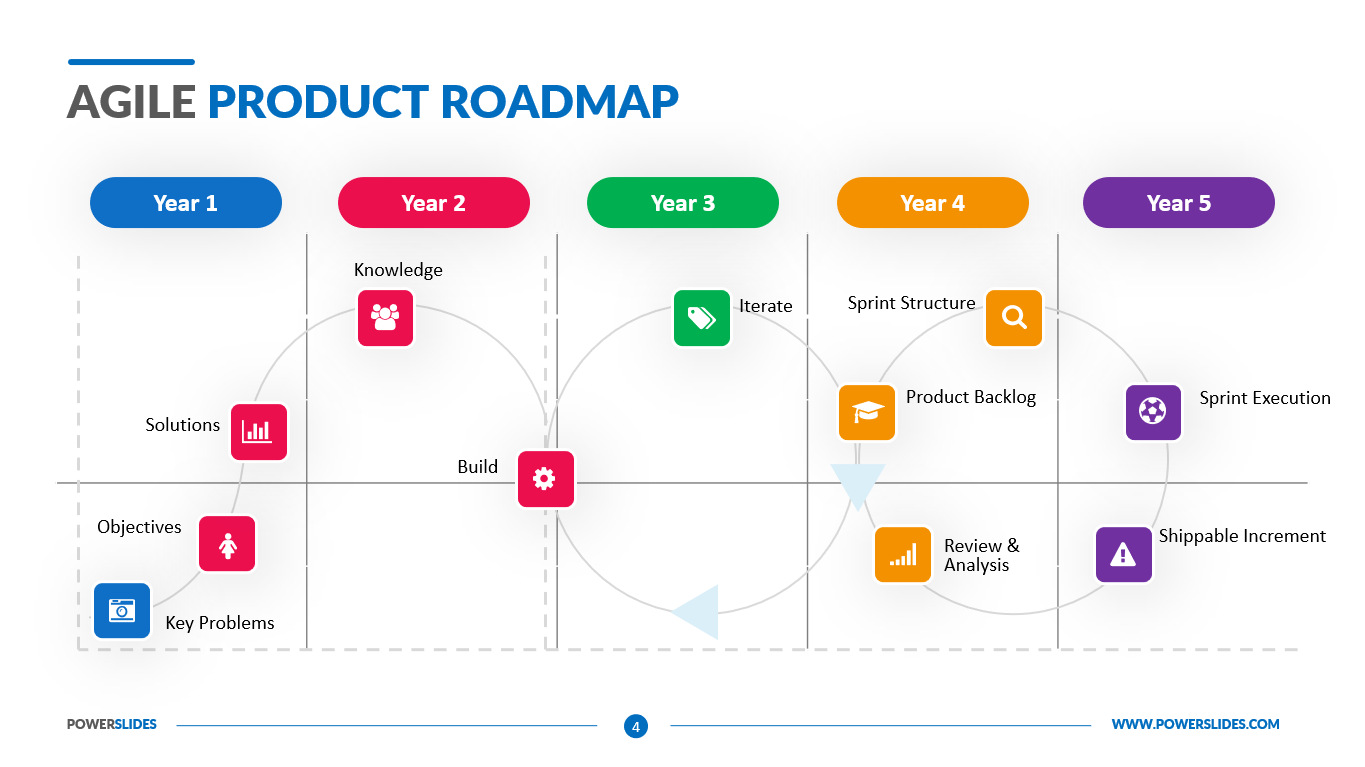

The audit risk model indicates the type of evidence that needs to be collected for each transaction class, disclosure, and account balance. It is best determined during the planning stage and only possesses little value in terms of evaluating audit performance.

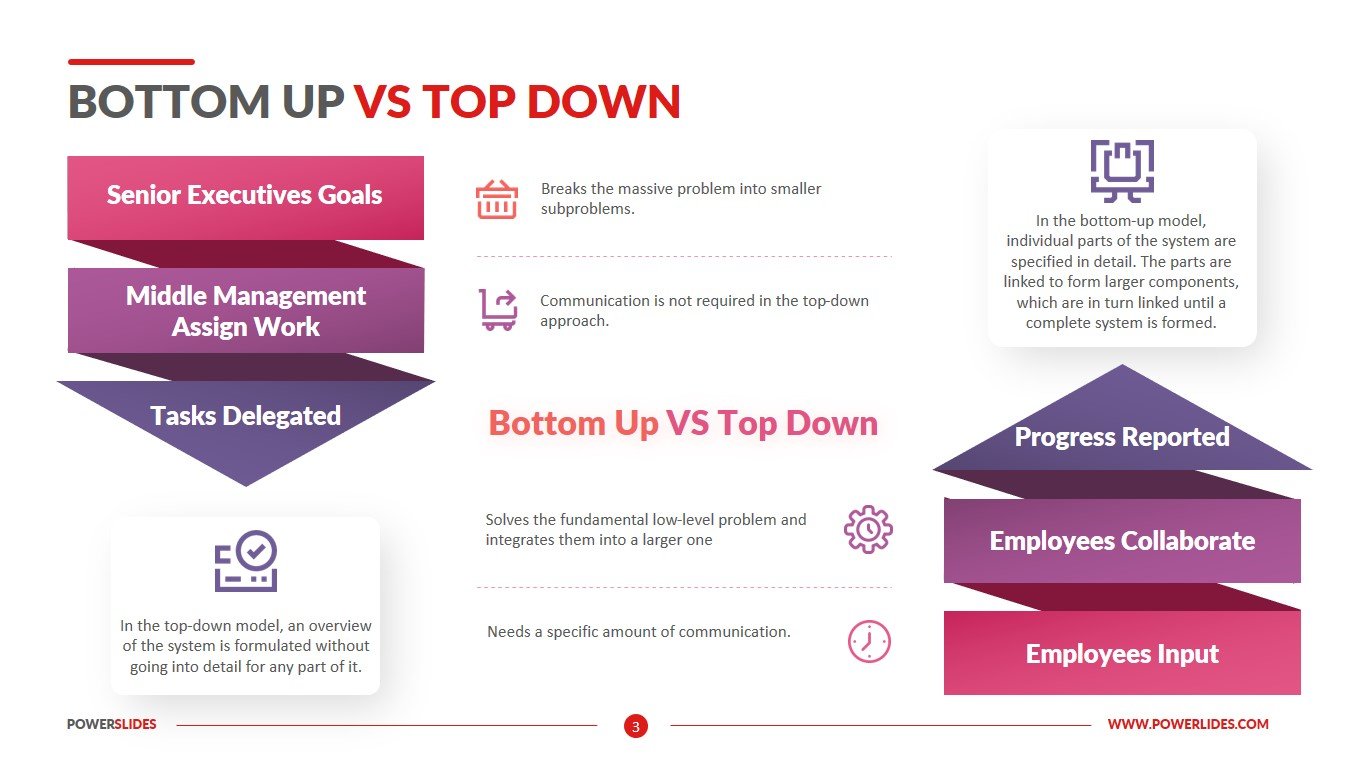

Audit Risk consist are Inherent Risk, Control Risk and Detection Risk. Inherent risk is the auditor’s assessment of the susceptibility to material misstatement of an assertion about a transaction class, an account balance. Control risk is the auditor’s assessment of how likely a material misstatement can occur in an assertion about a transaction class, account balance, or an attached disclosure and cannot be identified or prevented in a time-sensitive manner by the client’s pre-existing internal controls. Detection risk is the risk that audit evidence for any given audit assertion will fail to capture material misstatements.

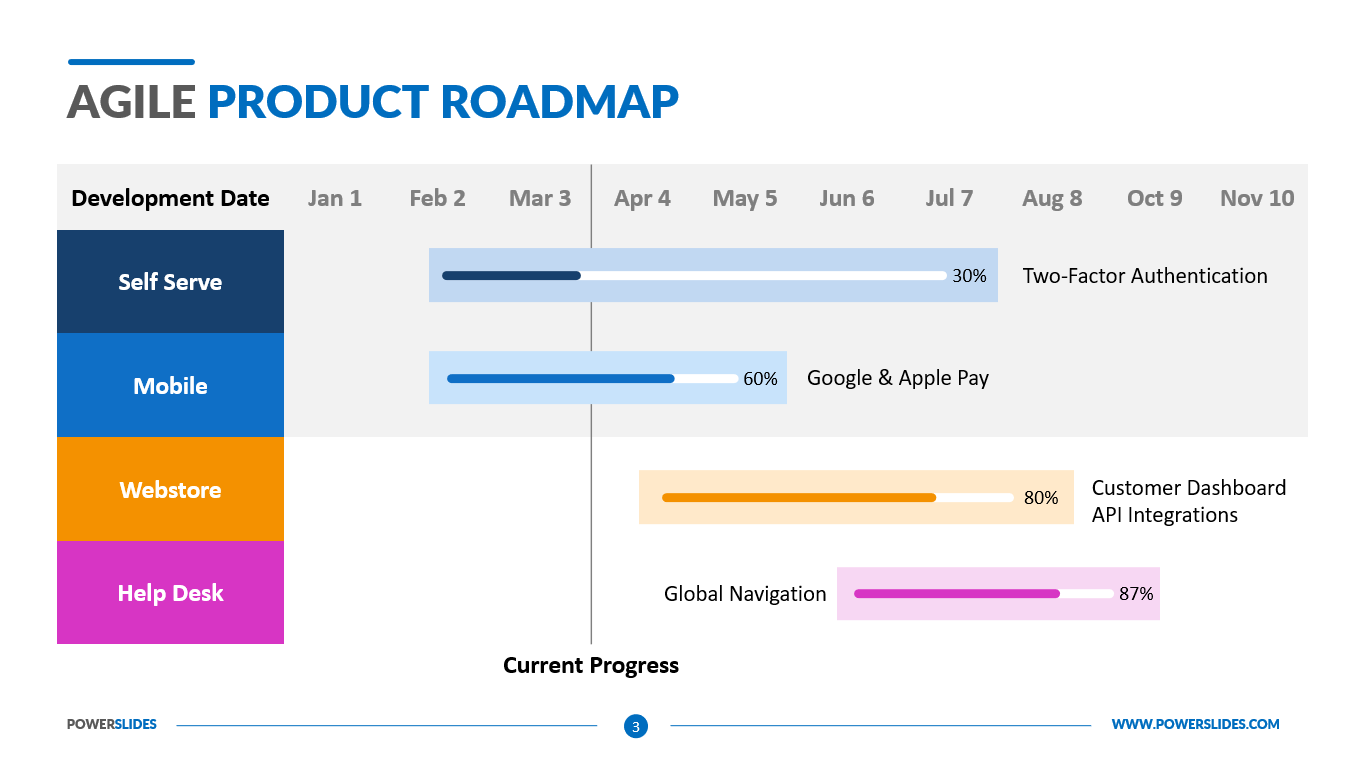

After analyzing the client’s business environment, the next phase of the audit risk model involves studying what internal controls the company has in place, how well they’re designed and if they’ve been implemented.

After analyzing internal and external factors that may influence the accuracy of the client organization’s financial statements, you can determine various aspects of your audit procedures, such as timing, nature and overall extent. As a general rule, you need to determine the aspects where risks are moderate to high and plan more rigorous testing to back your assertion.

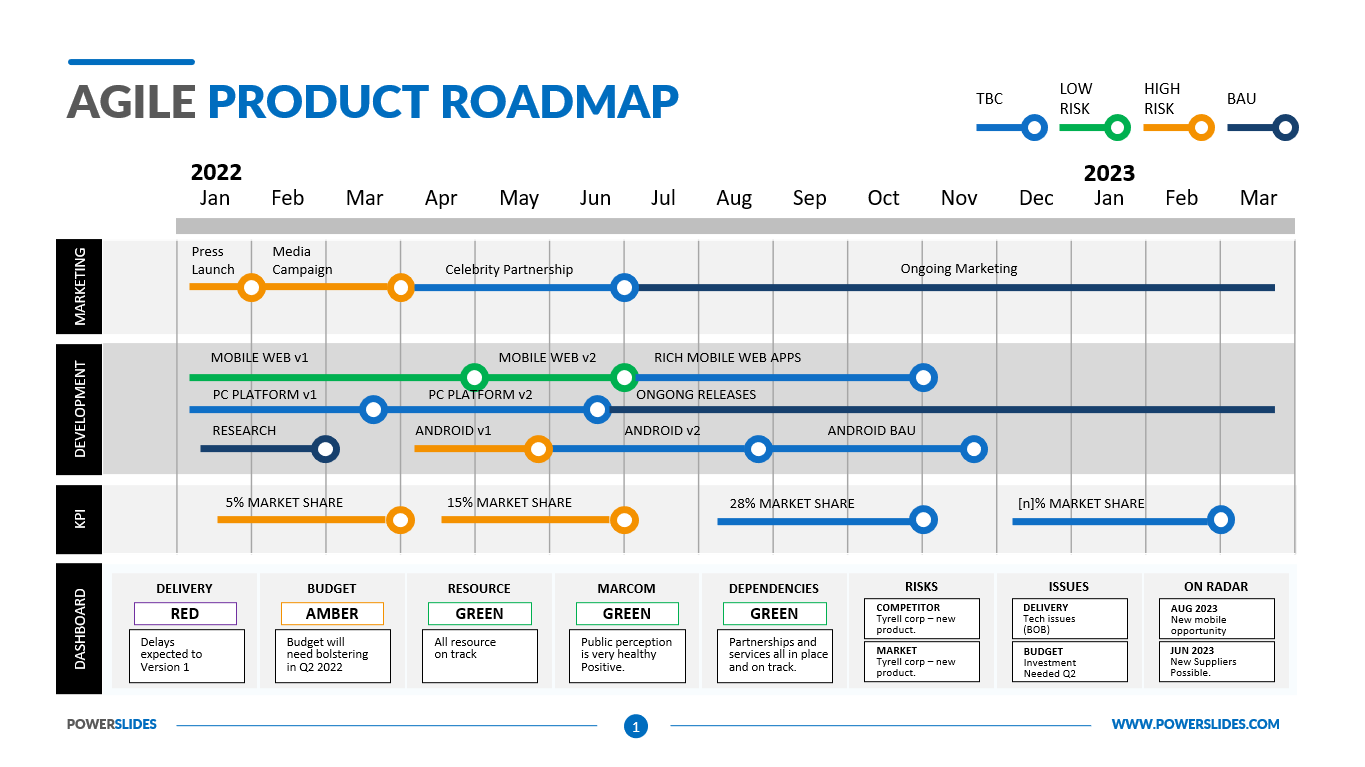

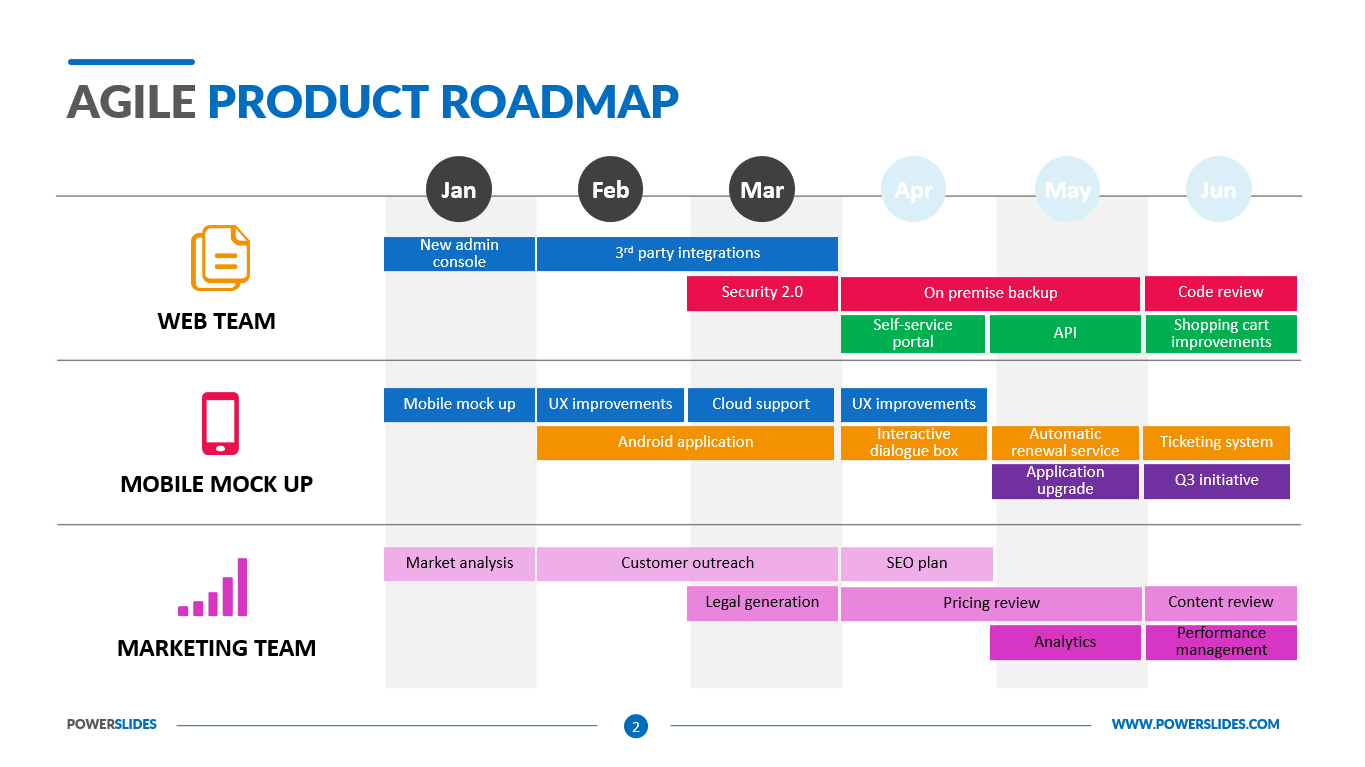

The first slide will be useful for CFOs of companies when preparing a financial management strategy in the company. You can use this slide when describing activities that will reduce or even eliminate the risks associated with conducting financial audits in the company. Also, this slide can be used by crisis managers when preparing their strategy for taking the company out of the crisis.

The second slide allows you to describe in detail the risks, their categories and the impact on the processes in the company. This slide can be used by startup executives in preparation for meeting with investors. For example, you can describe possible risks and present measures to reduce them.

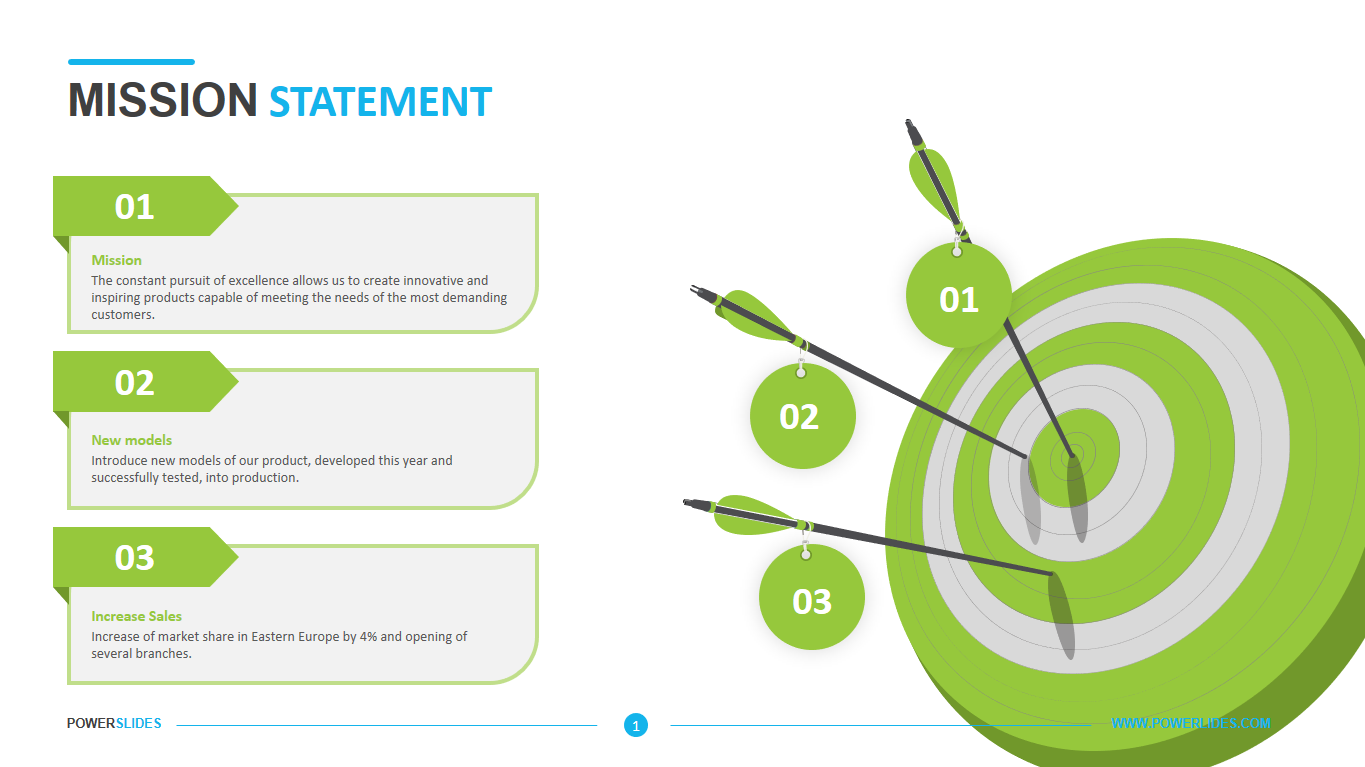

This template can be used by entrepreneurs when preparing a business plan and meeting with bank employees for a loan. You can use the last slide of this template to visualize your risk structure in a graphical model. Also, this template can be used by university teachers and business coaches when preparing their courses on financial risk management or audit in the enterprise.

Audit Risk Model The template consists of four professional and stylish infographic slides. You can independently change the size of the fonts, the position of the blocks on the slide and the color of the infographics in accordance with your requirements for the brand book. Audit Risk Model The template is a must-have for auditors and accountants of companies.