Credit Risk Modelling

4 Slides

4 Slides

File size: 16:9

File size: 16:9

Fonts: Lato Black, Calibri

Fonts: Lato Black, Calibri

Supported version

PPT 2010, PPT 2013, PPT 2016

Supported version

PPT 2010, PPT 2013, PPT 2016

Product details

Financial institutions used credit risk analysis models to determine the probability of default of a potential borrower. The models provide information on the level of a borrower’s credit risk at any particular time. If the lender fails to detect the credit risk in advance, it exposes them to the risk of default and loss of funds. Lenders rely on the validation provided by credit risk analysis models to make key lending decisions on whether or not to extend credit to the borrower and the credit to be charged.

With the continuous evolution of technology, banks are continually researching and developing effective ways of modeling credit risk. A growing number of financial institutions are investing in new technologies and human resources to make it possible to create credit risk models using machine learning languages, such as Python and other analytics-friendly languages. It ensures that the models created produce data that are both accurate and scientific.

Credit risk arises when a corporate or individual borrower fails to meet their debt obligations. It is the probability that the lender will not receive the principal and interest payments of a debt required to service the debt extended to a borrower.

On the side of the lender, credit risk will disrupt its cash flows and also increase collection costs, since the lender may be forced to hire a debt collection agency to enforce the collection.

The interest rate charged on a loan serves as the lender’s reward for accepting to bear credit risk. In an efficient market system, banks charge a high interest rate for high-risk loans as a way of compensating for the high risk of default. For example, a corporate borrower with a steady income and a good credit history can get credit at a lower interest rate than what high-risk borrowers would be charged.

Conversely, when transacting with a corporate borrower with a poor credit history, the lender can decide to charge a high interest rate for the loan or reject the loan application altogether. Lenders can use different methods to assess the level of credit risk of a potential borrower in order to mitigate losses and avoid delayed payments.

This template will be primarily useful for banking professionals. You can use this template when preparing a credit analysis of a potential borrower. For example, you can imagine the main risks of loan defaults and the collateral held by the borrower.

The slides of this template can also be used by crisis managers when analyzing a company’s credit potential. You can use the slides when predicting the possibility of obtaining a loan and the measures that are necessary to reduce the risks of loan defaults. Also, this template will be useful for university professors when preparing a course on financial risk management or credit risk assessment methodology.

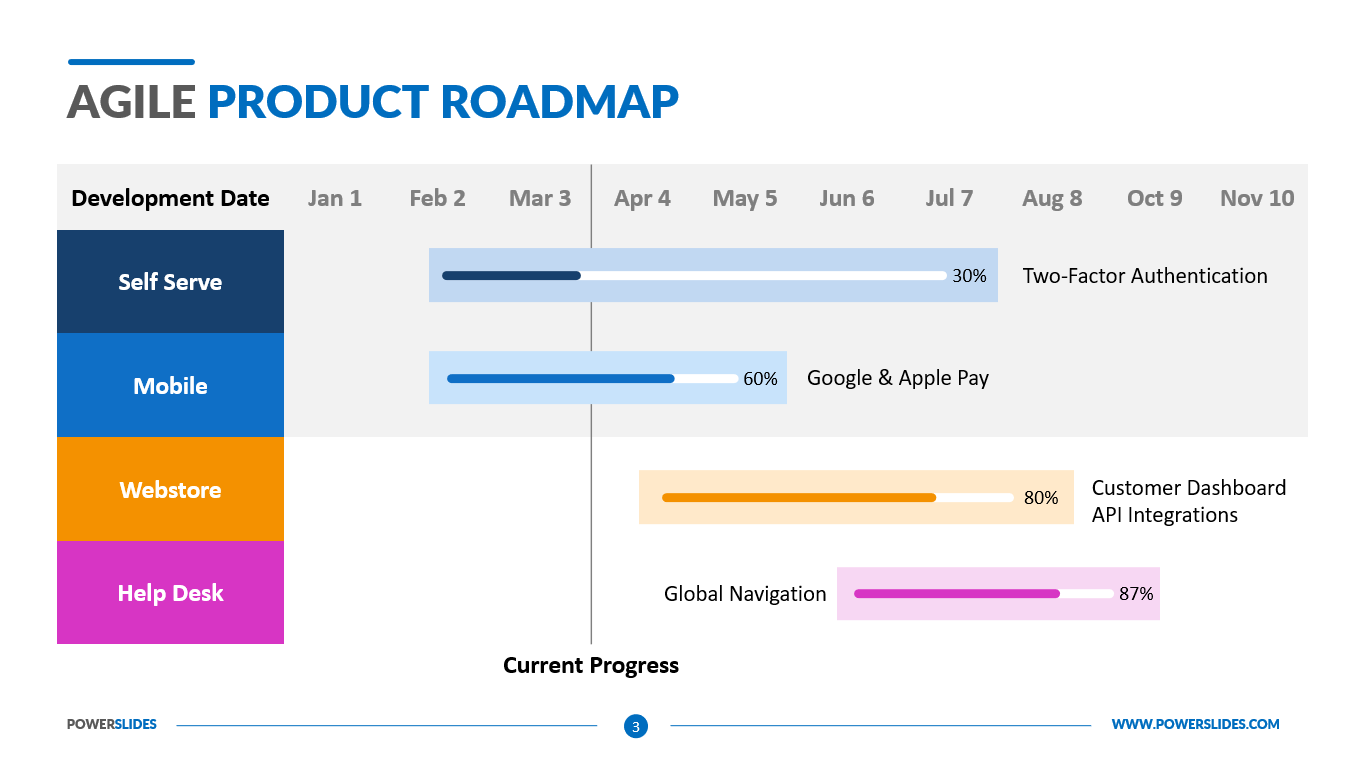

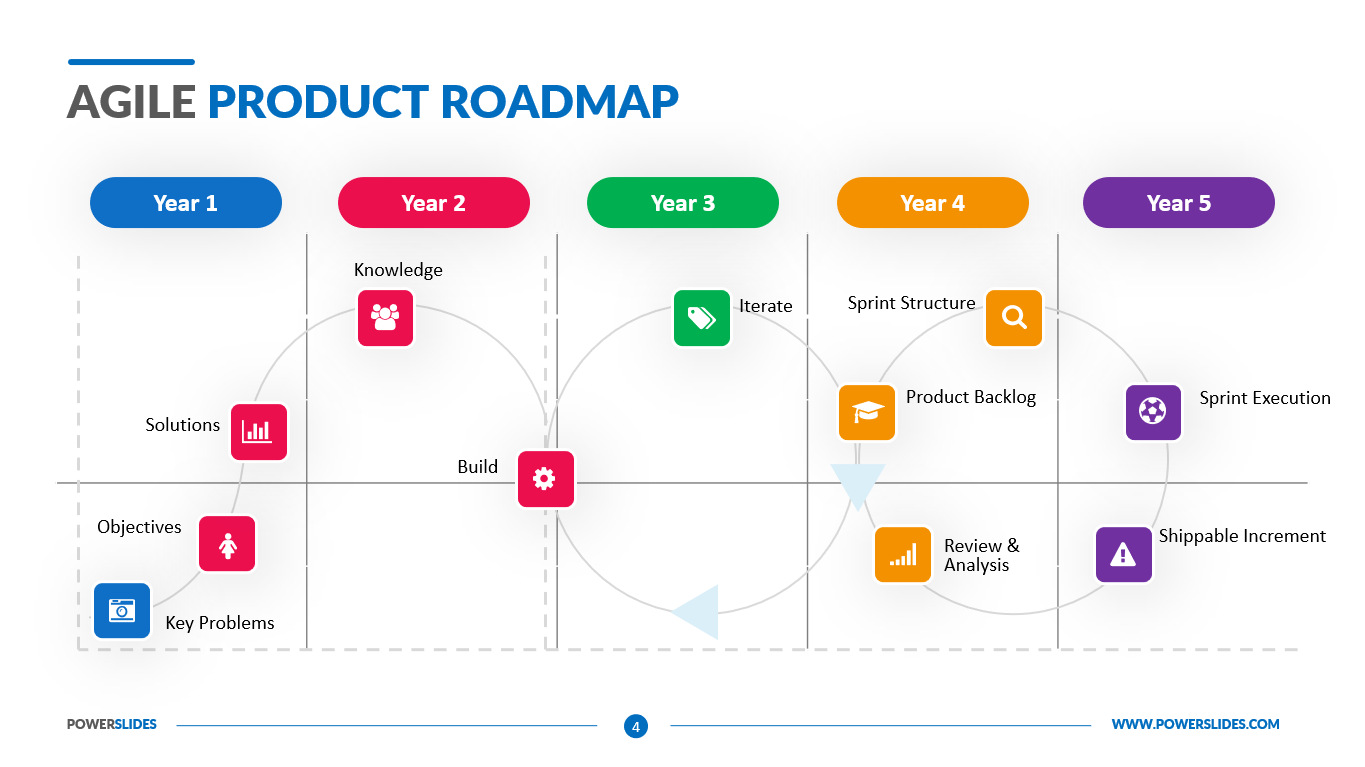

Credit Risk Modeling The template consists of four slides, each of which you can customize according to your needs. Credit Risk Modeling Template is a must-have for bank employees and financiers. This template will be a great addition to your professional presentation collection.