Balance Sheet

4 Slides

4 Slides

File size: 16:9

File size: 16:9

Fonts: Lato Black, Calibri

Fonts: Lato Black, Calibri

Supported version

PPT 2010, PPT 2013, PPT 2016

Supported version

PPT 2010, PPT 2013, PPT 2016

Product details

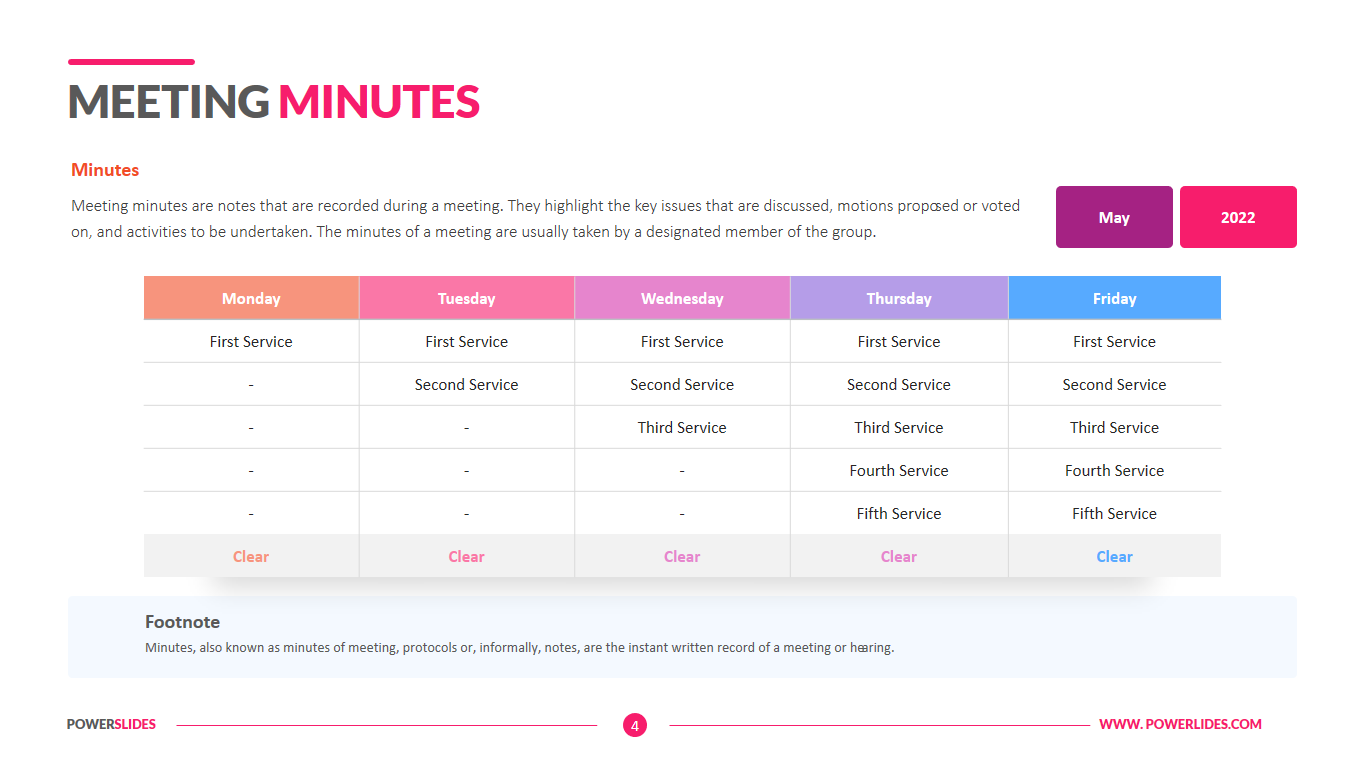

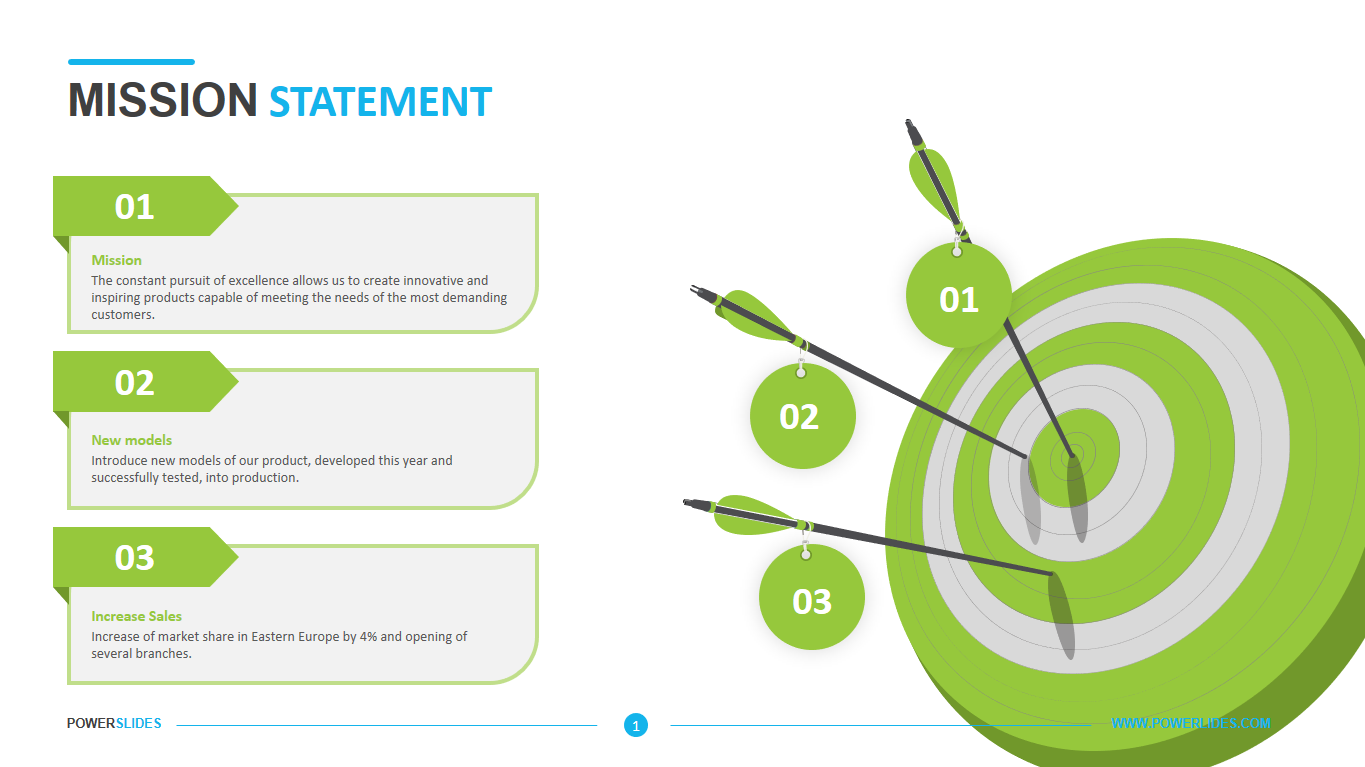

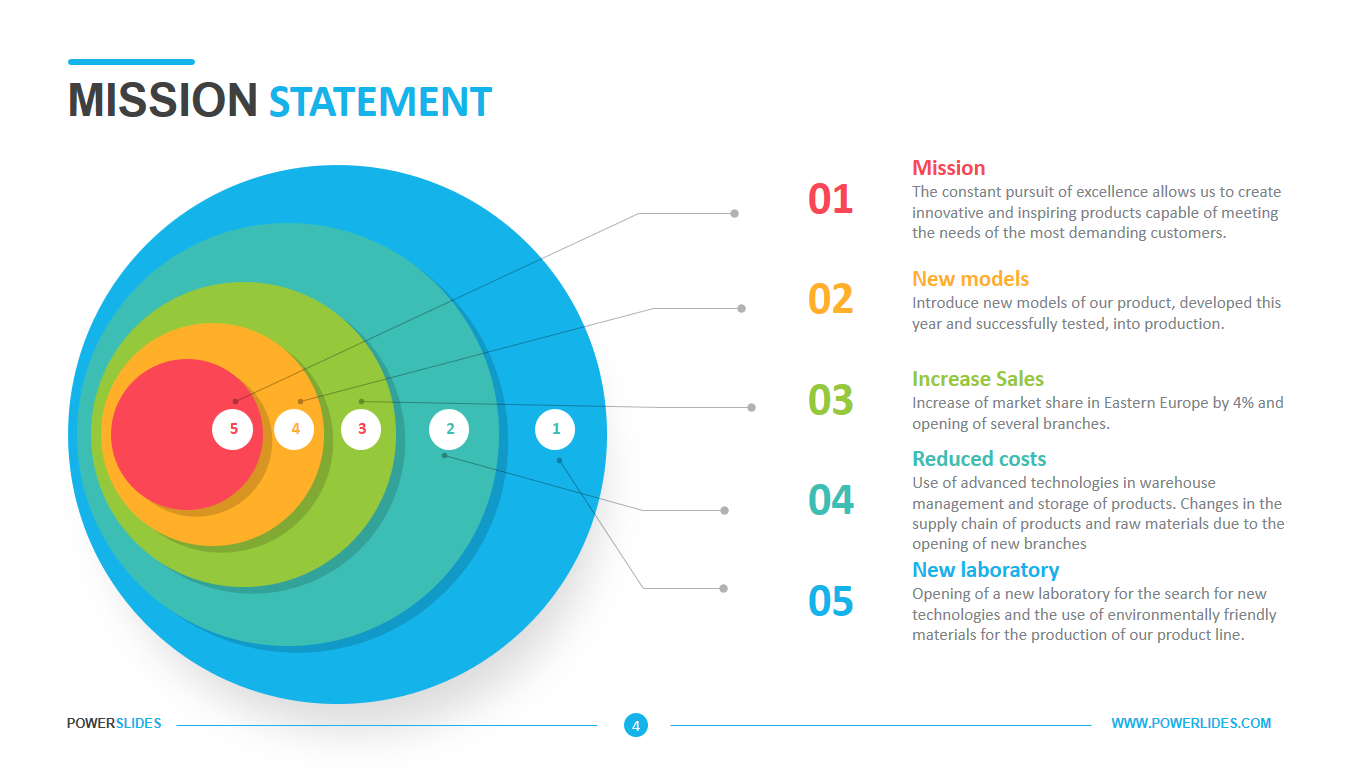

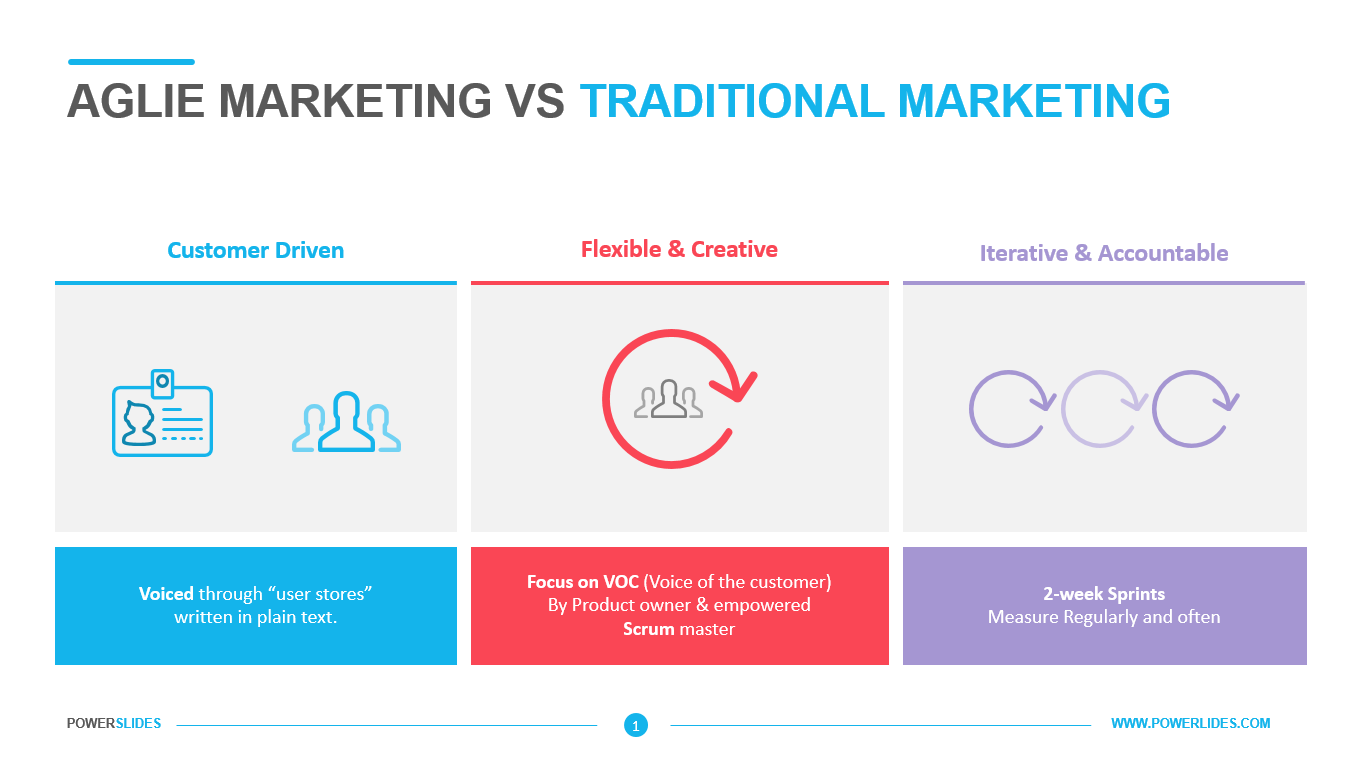

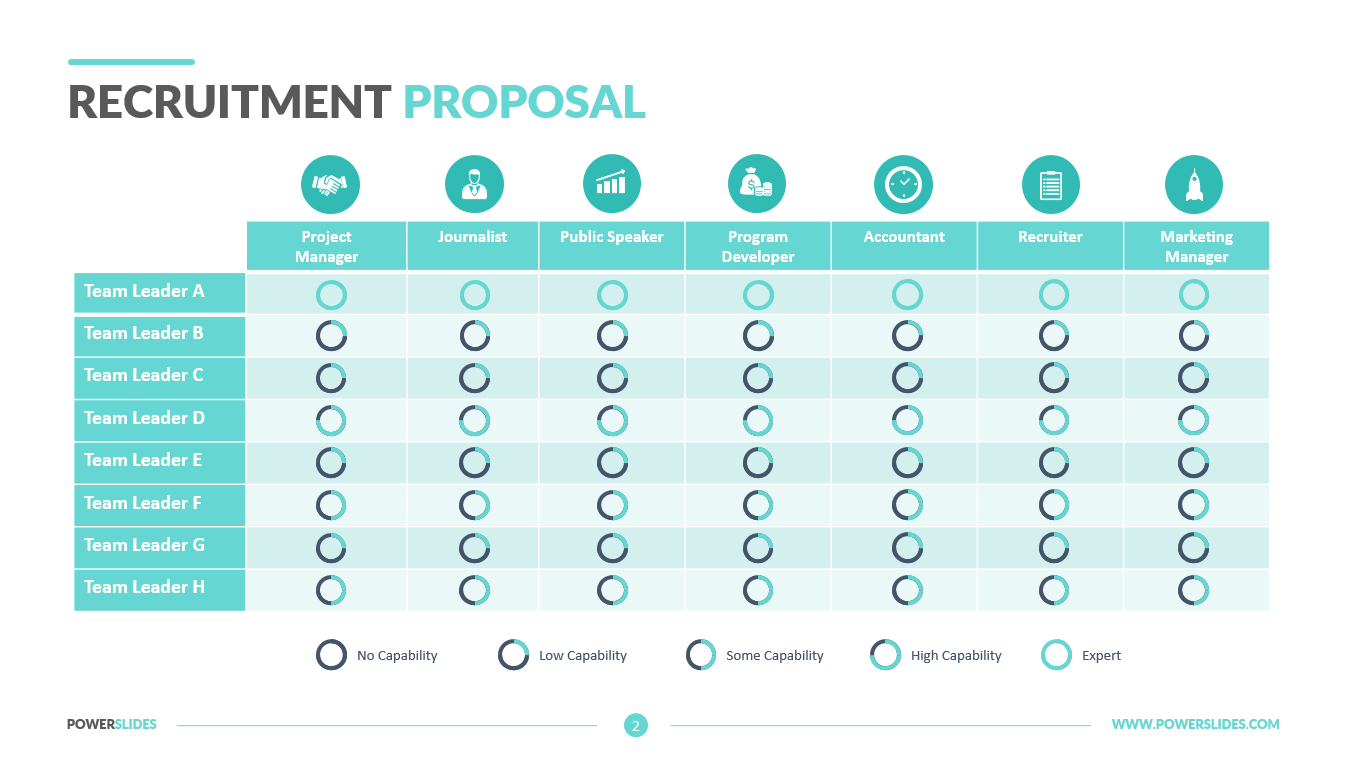

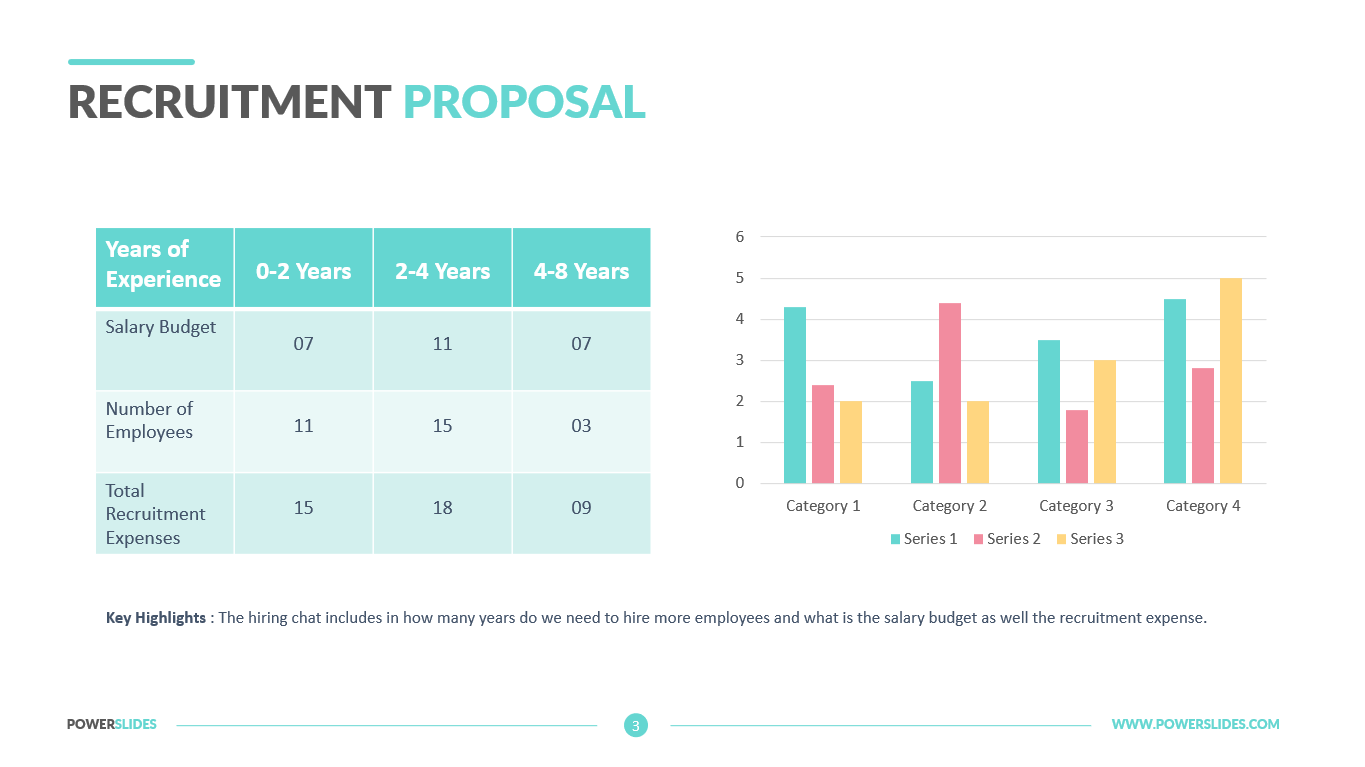

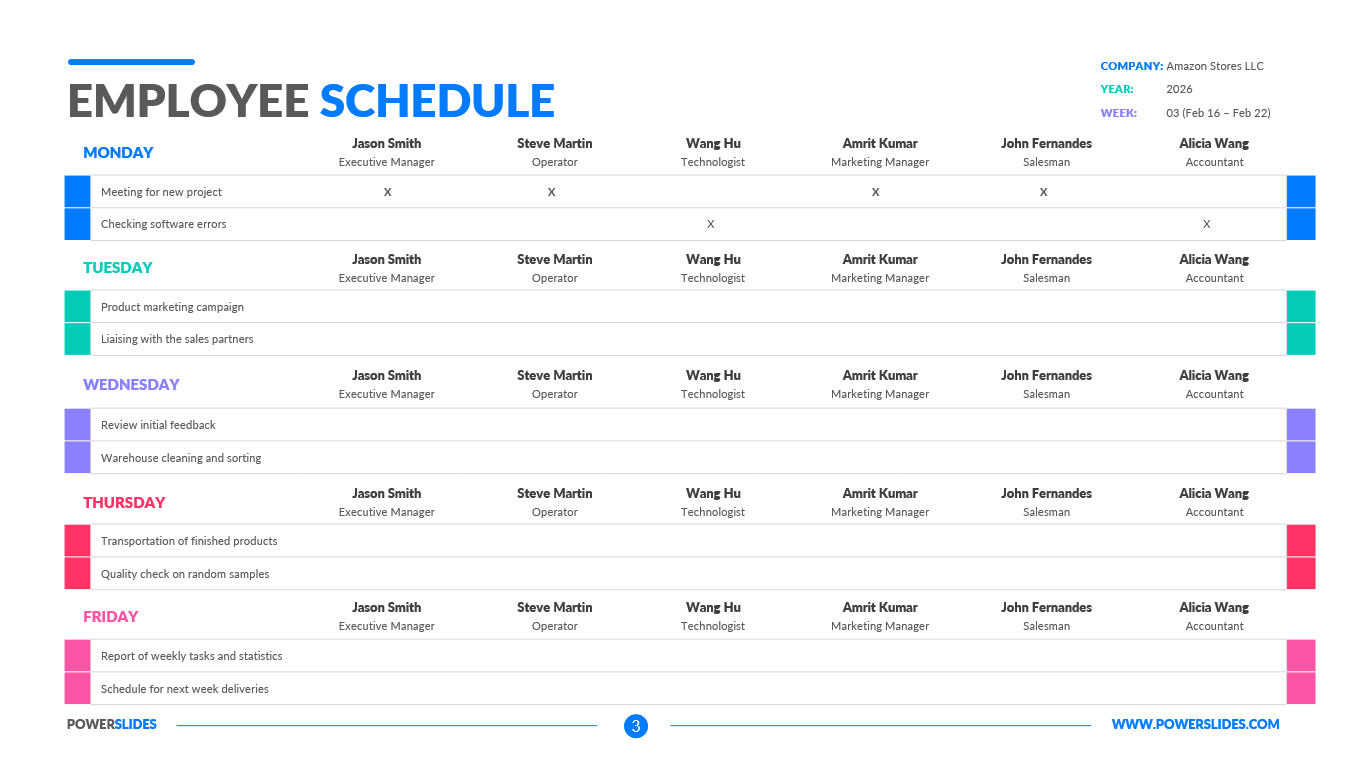

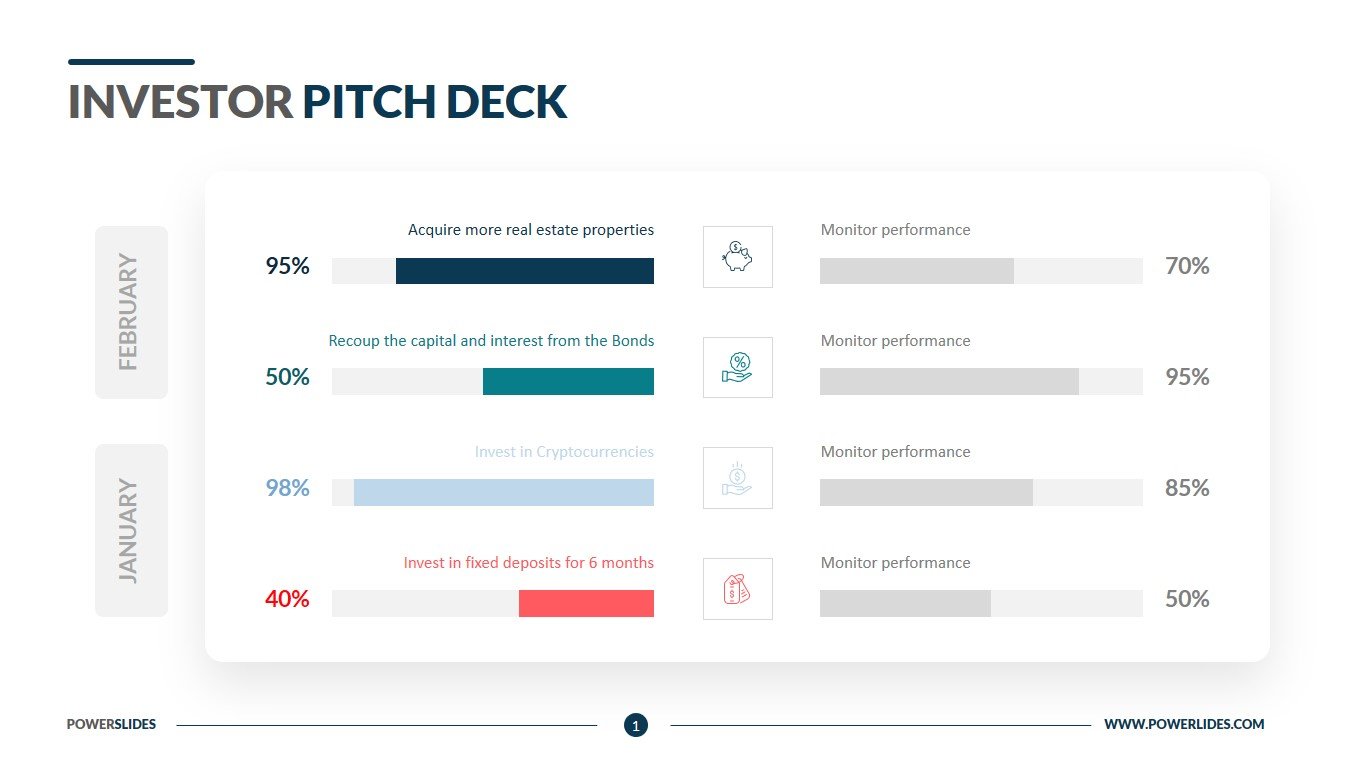

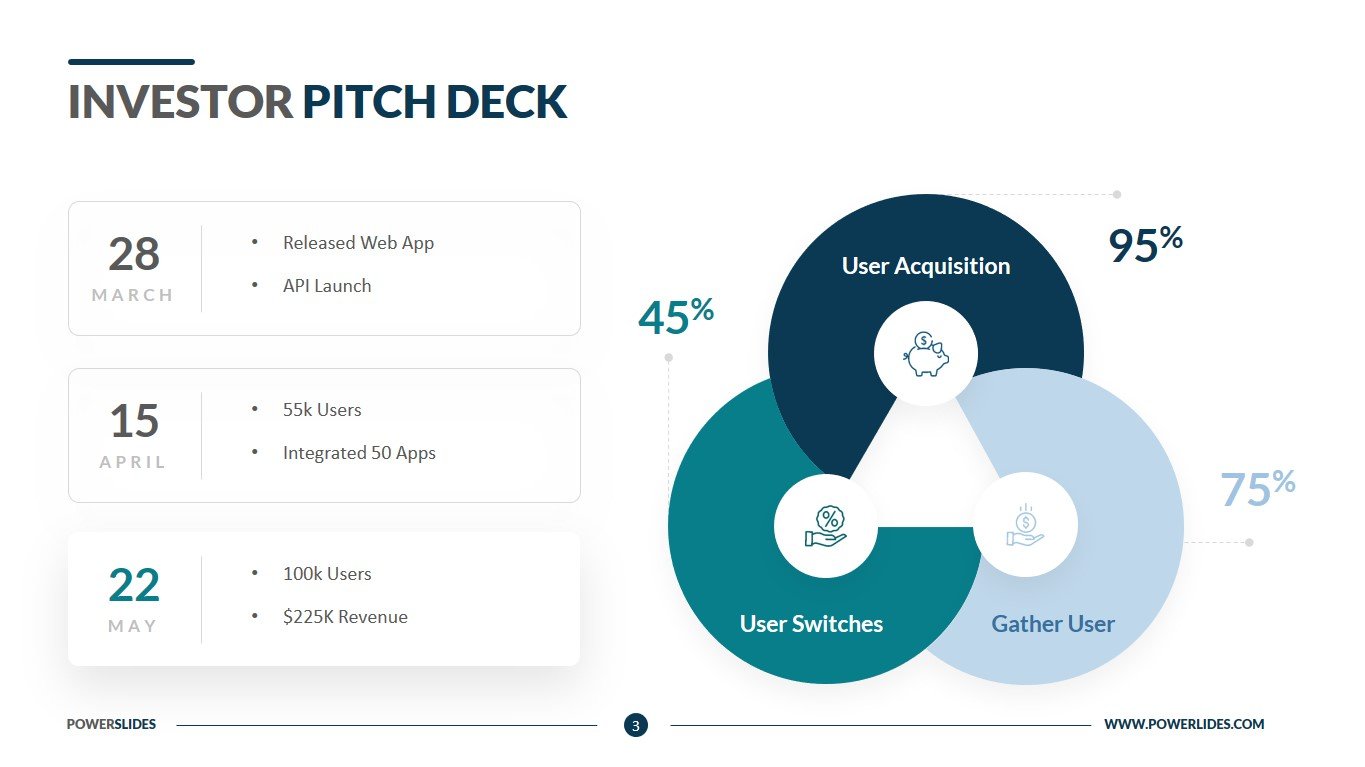

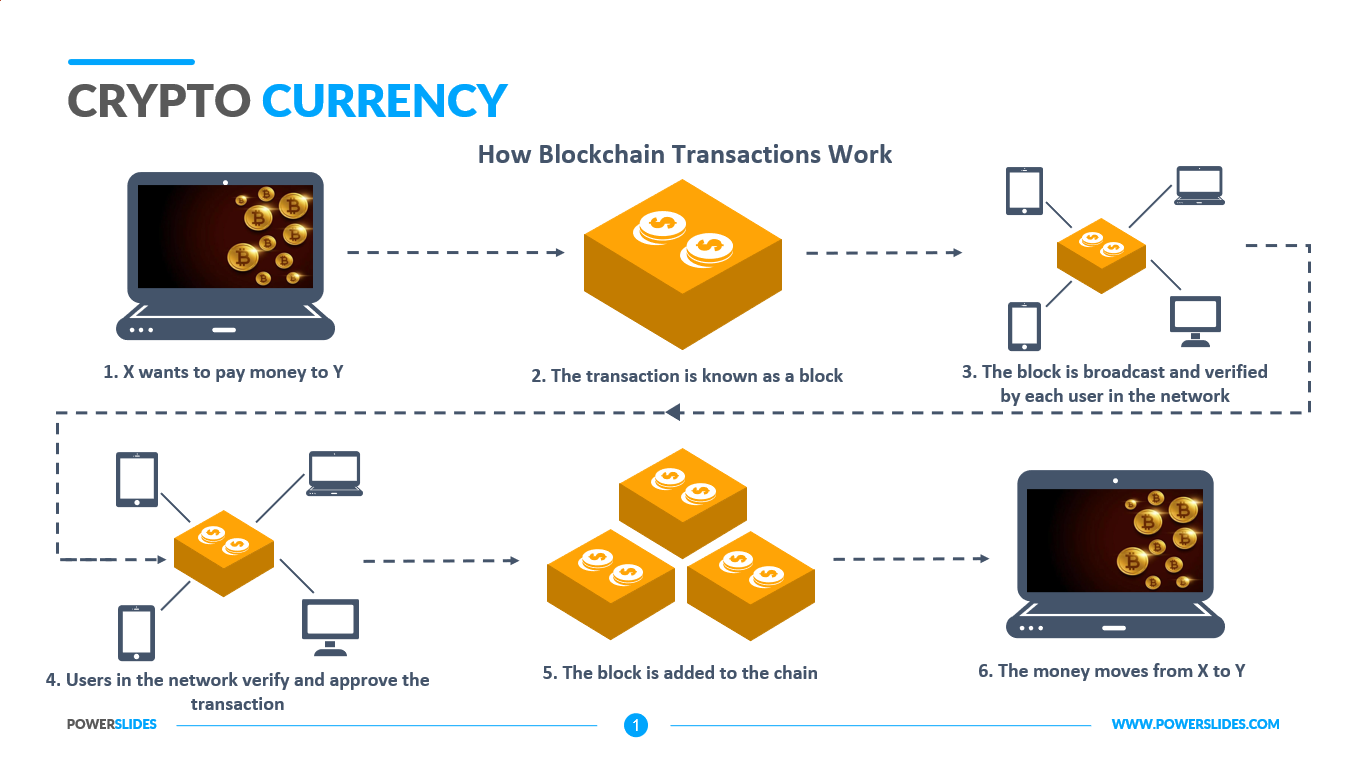

A balance sheet is a financial statement that reports a company’s assets, liabilities and shareholders’ equity at a specific point in time, and provides a basis for computing rates of return and evaluating its capital structure. It is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. The balance sheet is used alongside other important financial statements such as the income statement and statement of cash flows in conducting fundamental analysis or calculating financial ratios. The balance sheet adheres to the following accounting equation, where assets on one side, and liabilities plus shareholders’ equity on the other, balance out. A company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholders’ equity). Assets, liabilities and shareholders’ equity each consist of several smaller accounts that break down the specifics of a company’s finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. Broadly, however, there are a few common components investors are likely to come across. The balance sheet is a snapshot representing the state of a company’s finances at a moment in time. By itself, it cannot give a sense of the trends that are playing out over a longer period. For this reason, the balance sheet should be compared with those of previous periods. It should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing. A number of ratios can be derived from the balance sheet, helping investors get a sense of how healthy a company is. These include the debt-to-equity ratio and the acid-test ratio, along with many others. The income statement and statement of cash flows also provide a valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet.

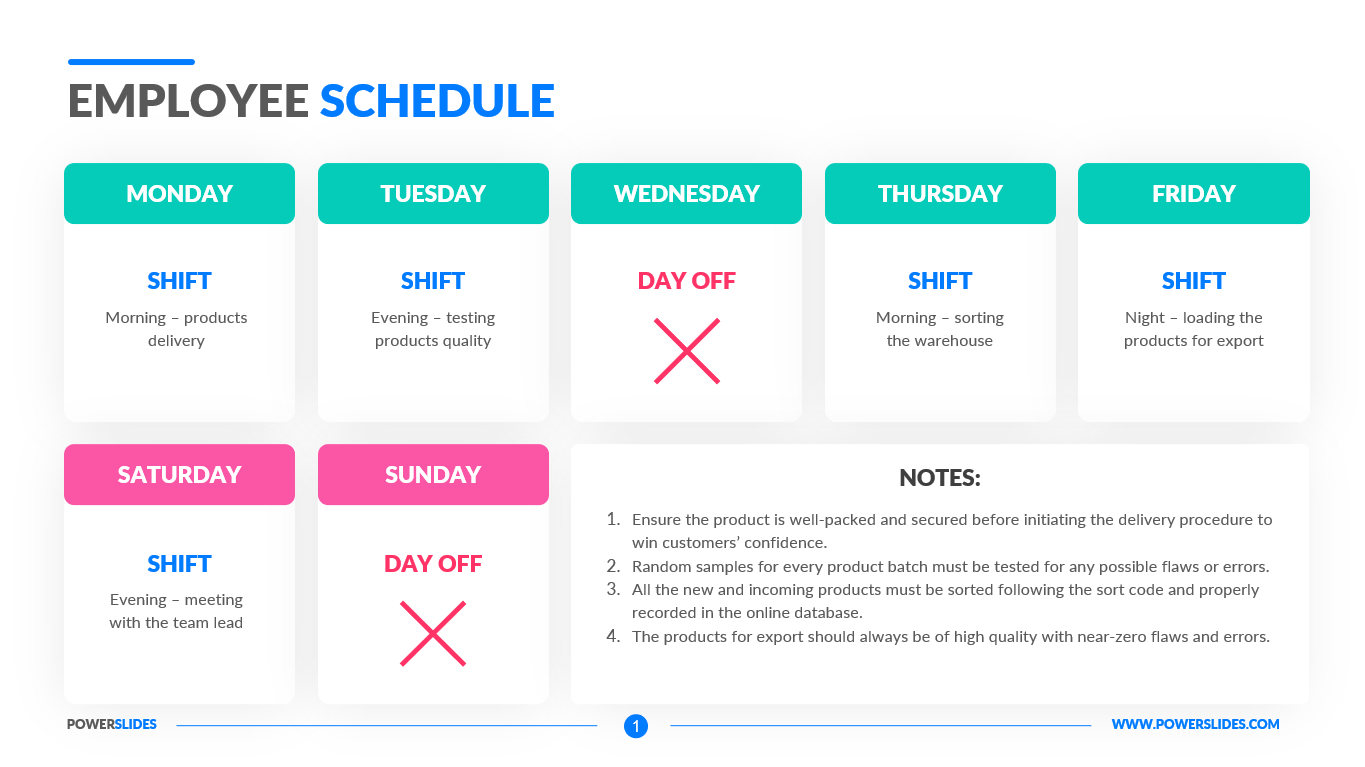

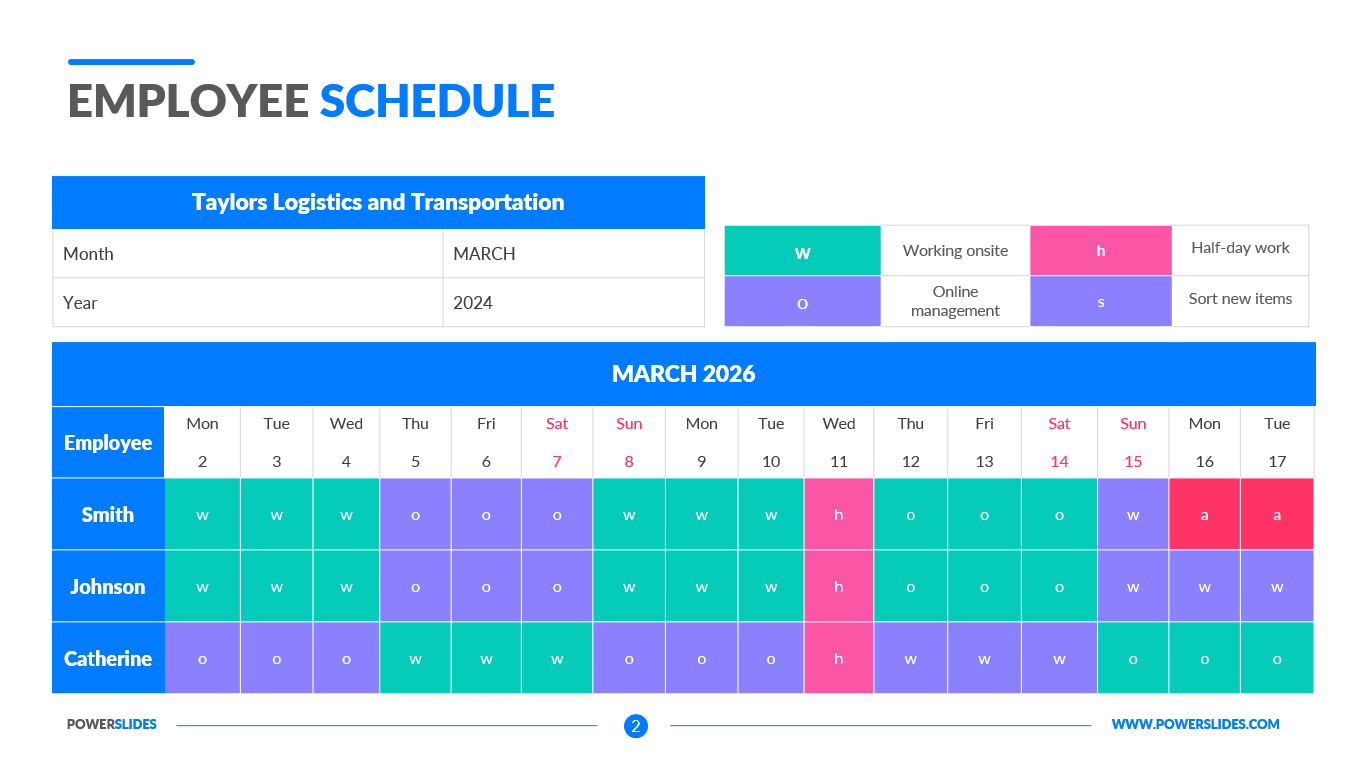

Balance Sheet template contains a large number of infographics, tables and graphs. This template will be primarily useful for accountants. You can use this template when preparing your company’s balance sheet information. You can display cash receipts, loan funds and show various financial ratios. This template will also be useful for startups and investment companies when preparing information for investors about the company’s balance sheet. This template can also be used by company leaders when preparing for a meeting with shareholders. If necessary, you can independently change the size, position and colour of blocks and infographics. Also, this template will be useful for the financiers and economists of the company. Also, this template will be useful for crisis managers when preparing a strategy for taking the company out of the crisis. The slides of this template will organically complement your old presentations.