Enterprise Risk Management Framework

4 Slides

4 Slides

File size: 16:9

File size: 16:9

Fonts: Lato Black, Calibri

Fonts: Lato Black, Calibri  Supported version

PPT 2010, PPT 2013, PPT 2016

Supported version

PPT 2010, PPT 2013, PPT 2016

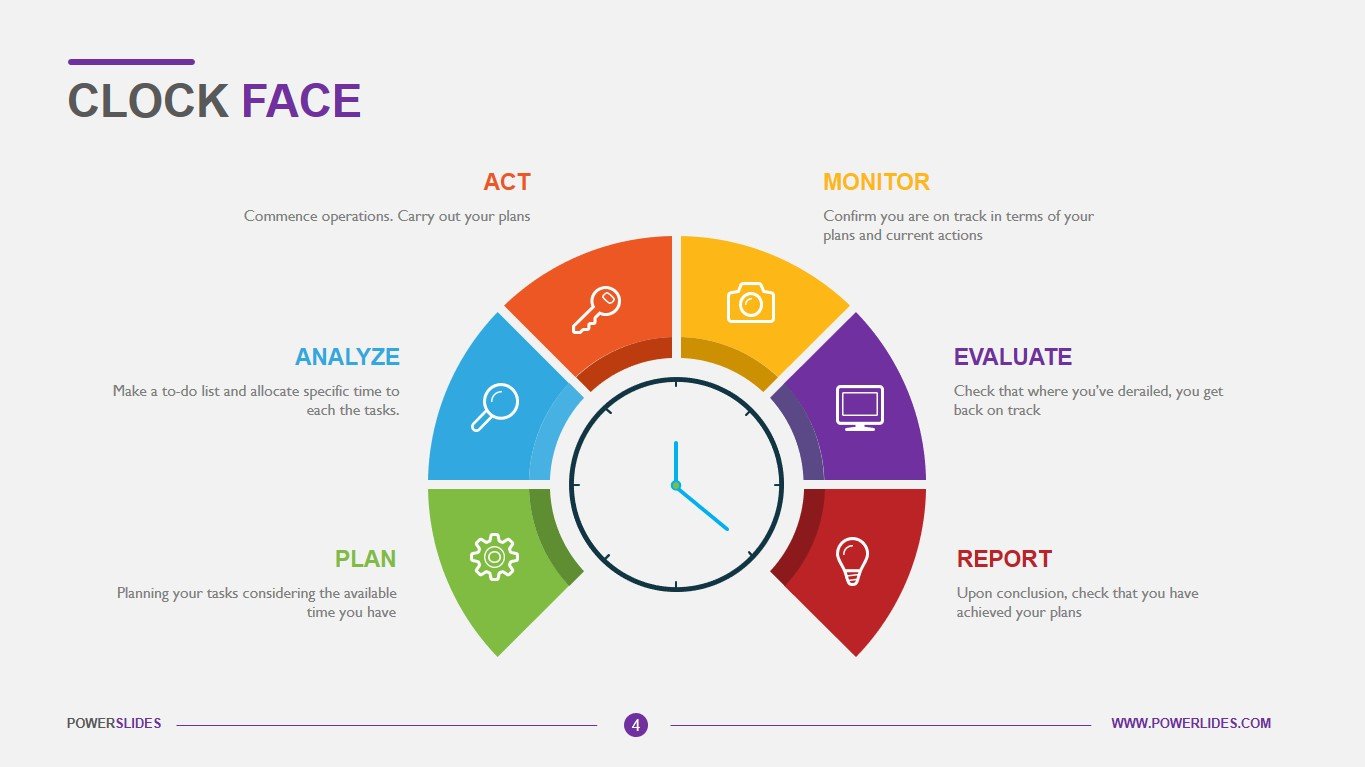

Product details

Enterprise risk management is a plan-based business strategy that aims to identify, assess, and prepare for any dangers, hazards, and other potentials for disaster both physical and figurative that may interfere with an organization’s operations and objectives. The discipline not only calls for corporations to identify all the risks they face and to decide which risks to manage actively. But it also involves making that plan of action available to all stakeholders, shareholders and potential investors, as part of their annual reports. Industries, as varied as aviation, construction, public health, international development, energy, finance, and insurance all, utilize enterprise risk management. Companies have been managing risk for years. They have done this by buying insurance – property insurance for literal, detrimental losses due to fires, thefts, and natural disasters; and liability insurance and malpractice insurance to deal with lawsuits and claims of damage, loss, or injury. But another key element in enterprise risk management is a business risk. More recently, companies have managed such risks through the capital markets with derivative instruments that help them manage the ups and downs of moment-to-moment movements in currencies, interest rates, commodity prices, and equities. The risk management function must establish and educate the organization on common terminology regarding risk. Common terminology will facilitate communication across business units. It is important to establish a senior management level committee to provide oversight of the implementation of the enterprise risk management framework. In addition, the committee will help delineate the roles and responsibilities within the framework. Firms will generally run out of resources before they run out of risk therefore the High-risk items must be given priority. Target completion dates and responsible owners must be selected to facilitate the risk mitigation process. Enterprise risk management implementation is not considered an easy task. It requires organizational cooperation and a strong senior management team.

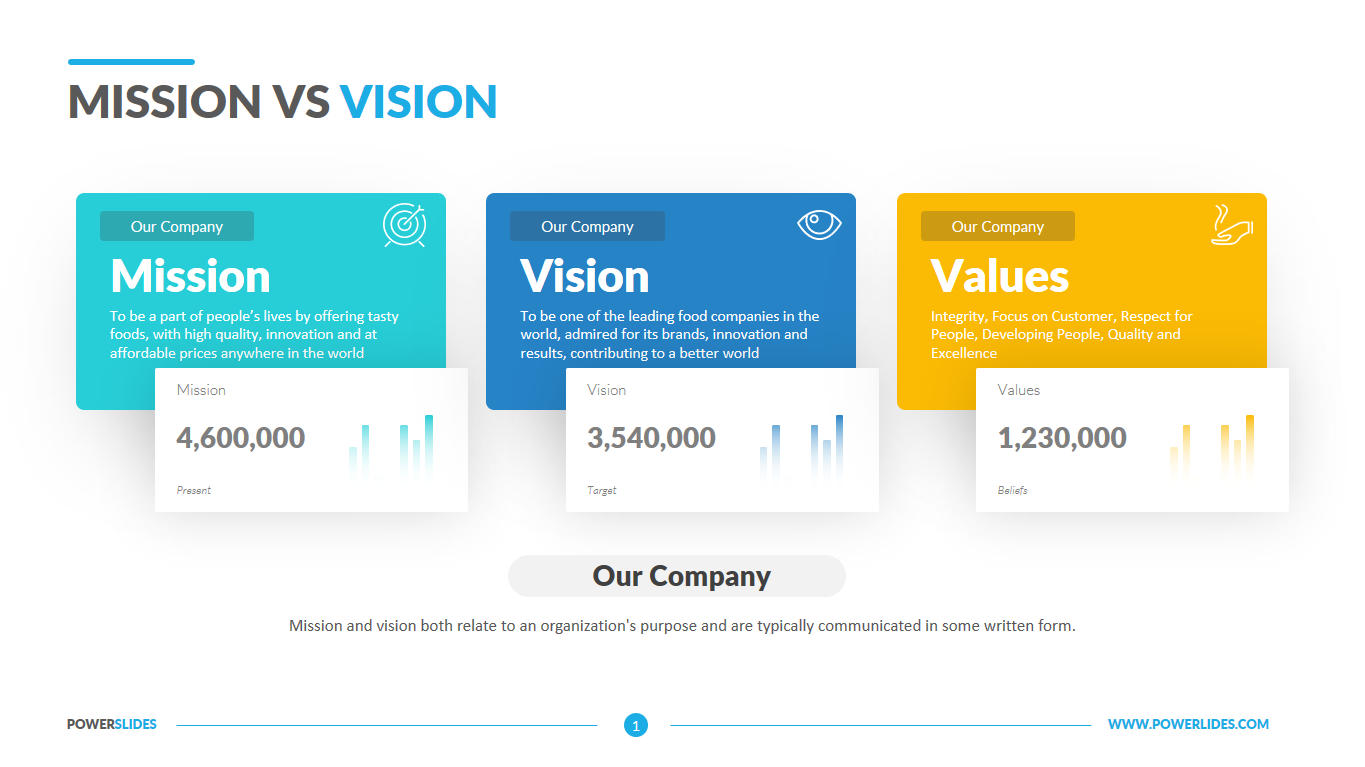

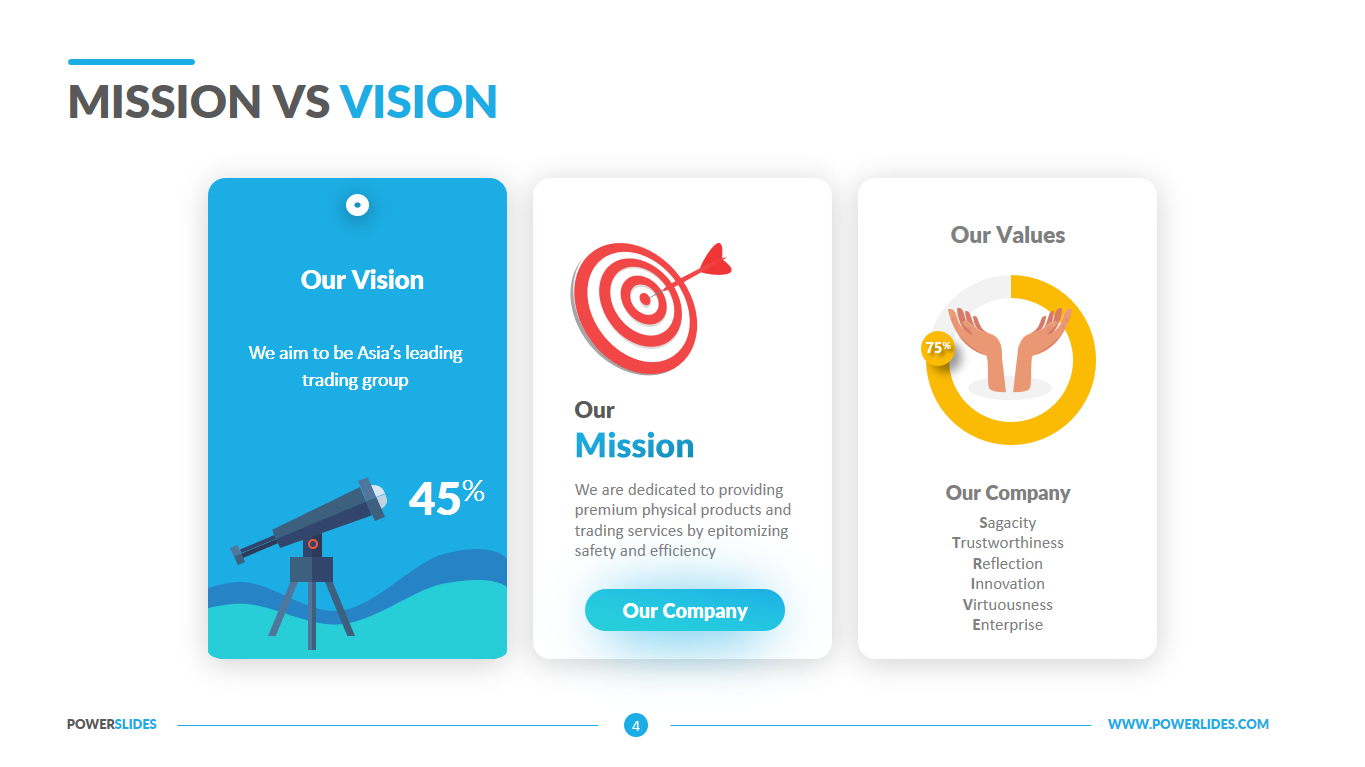

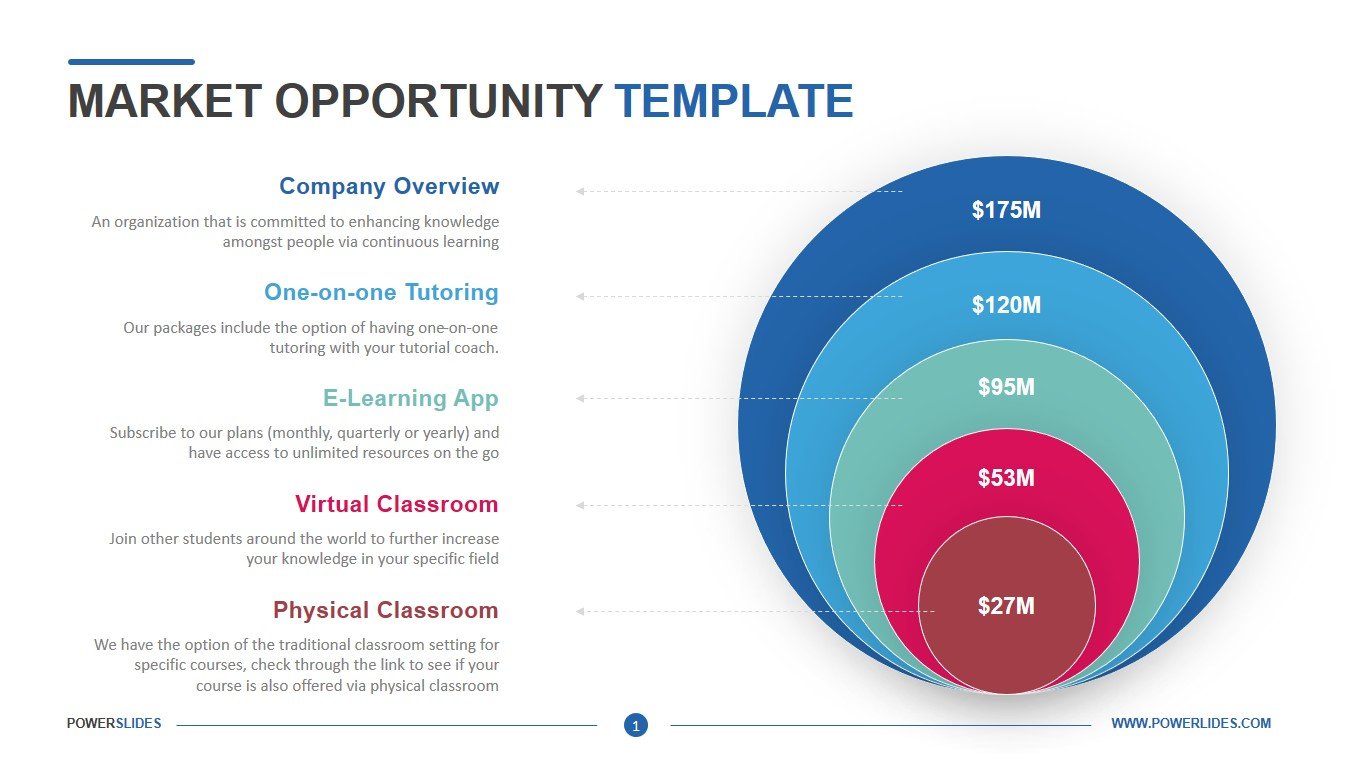

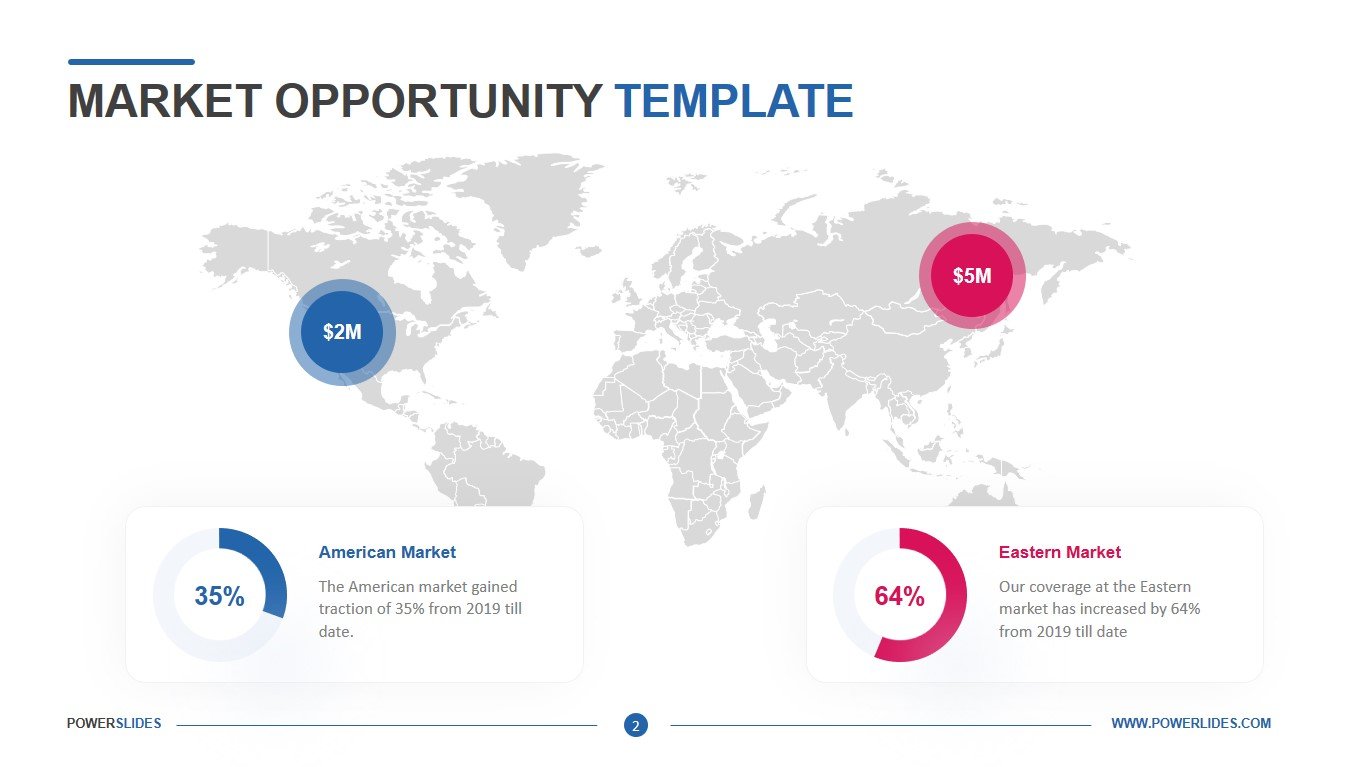

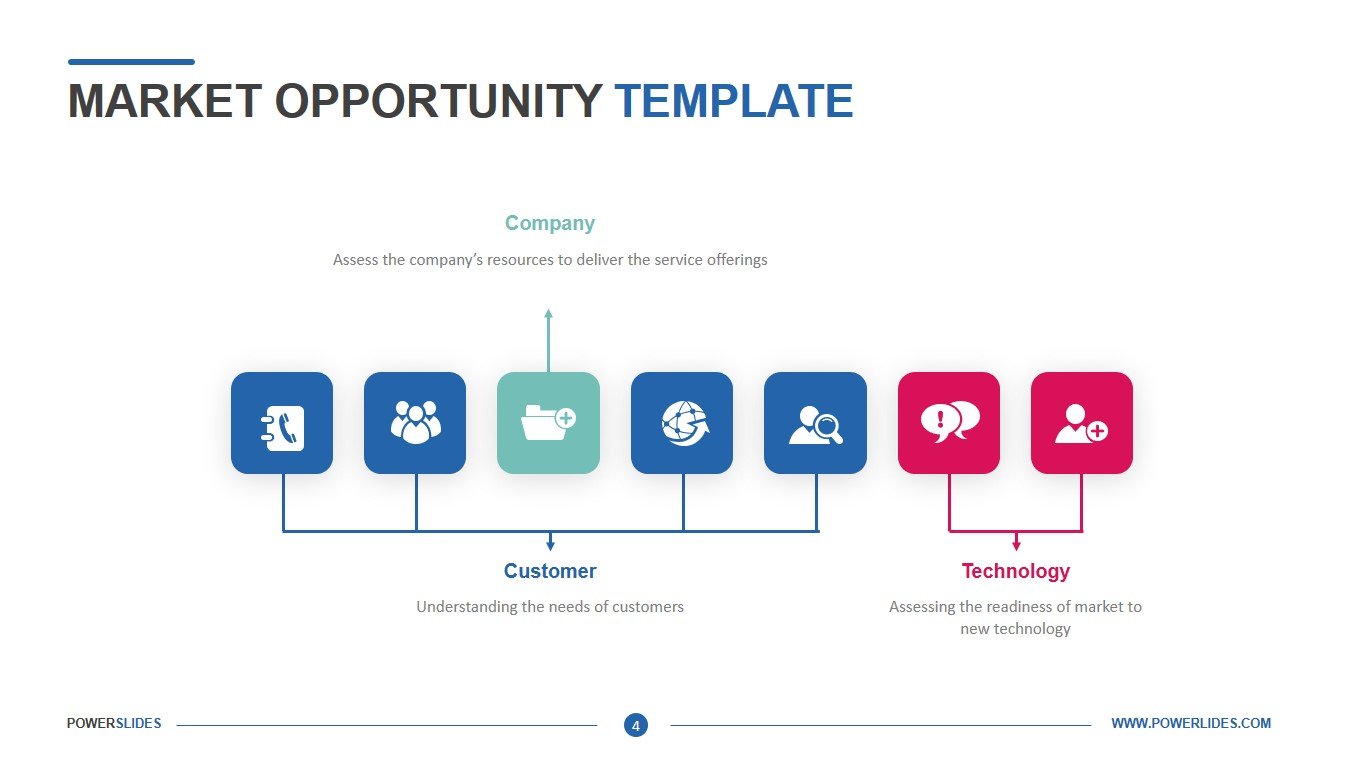

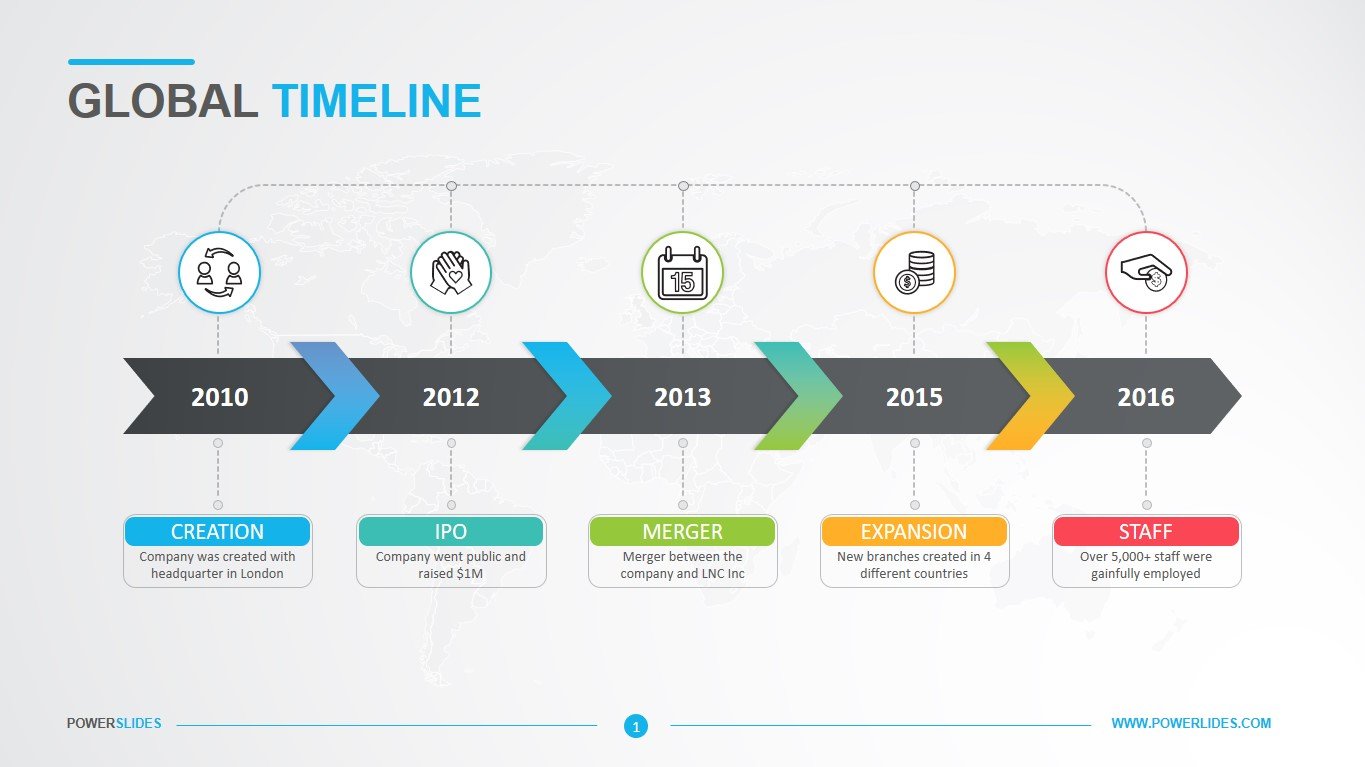

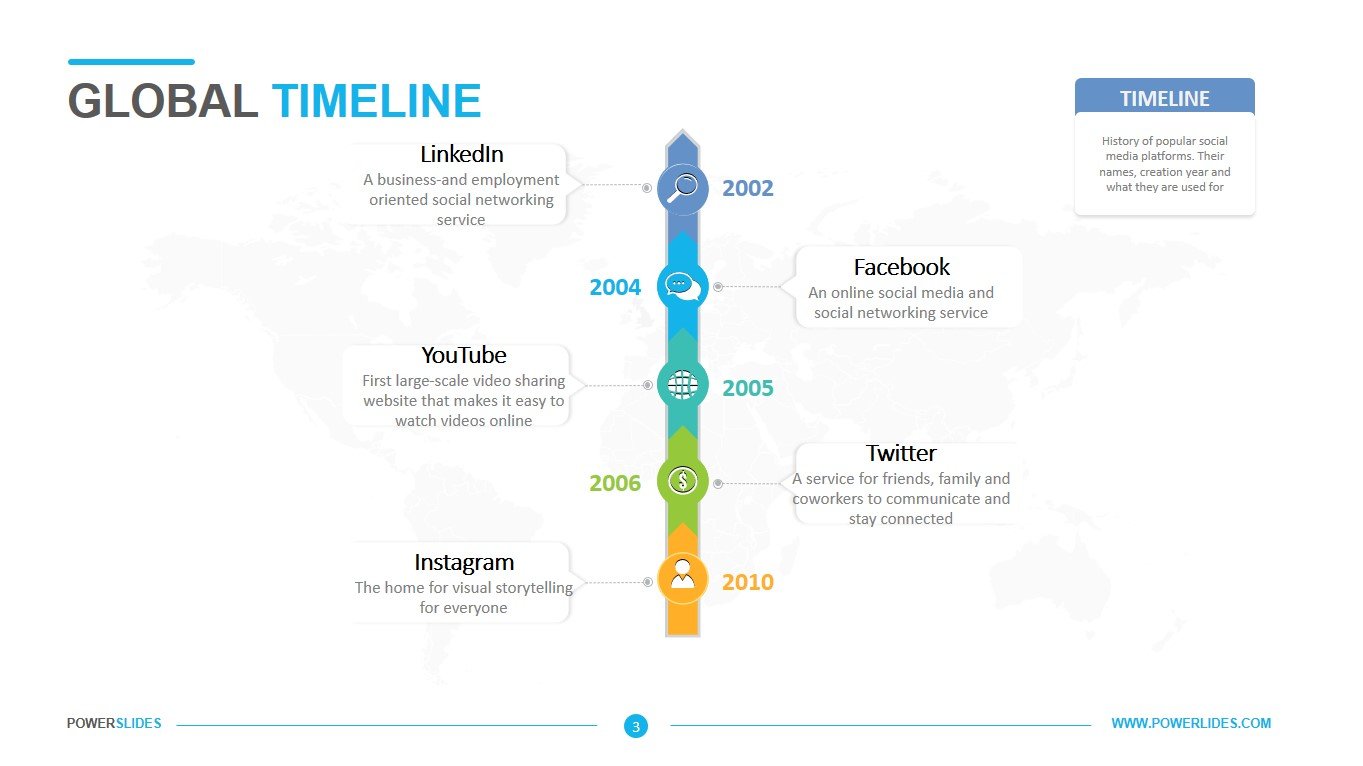

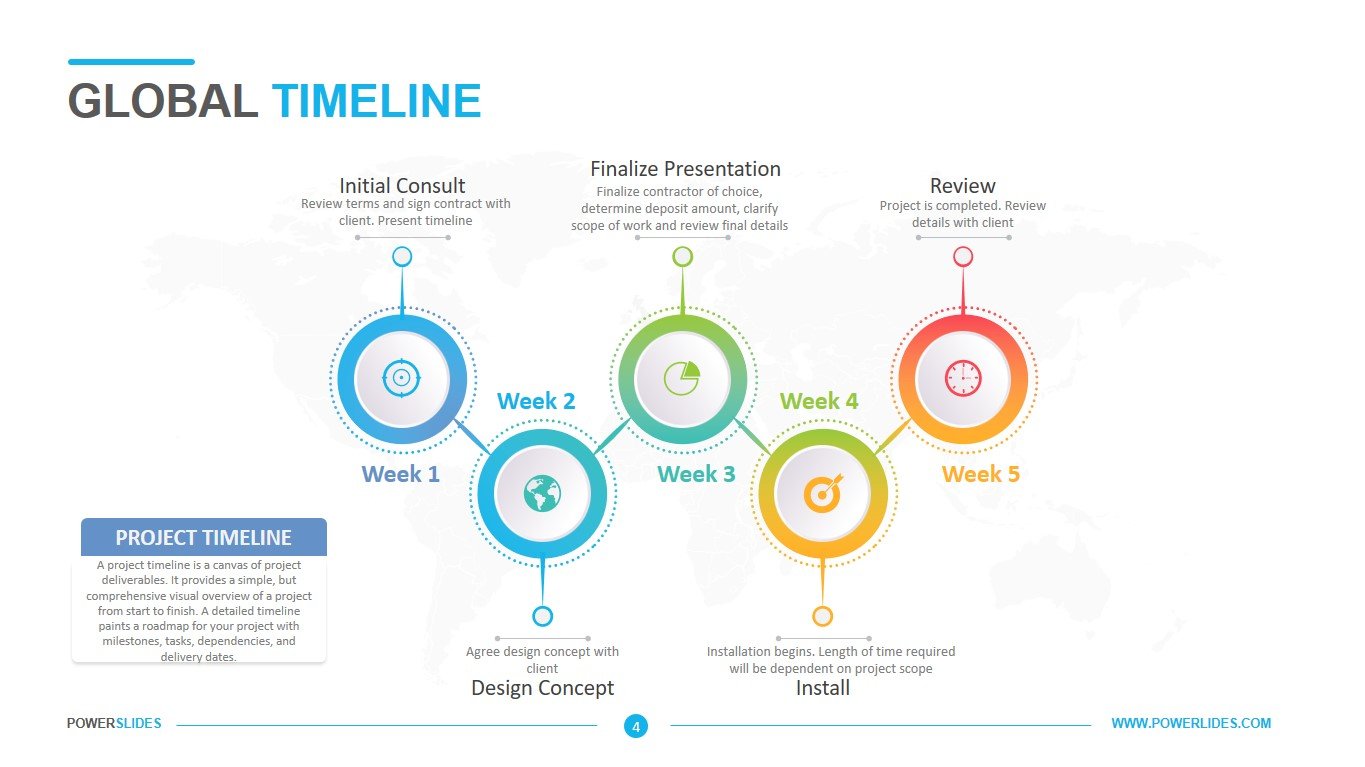

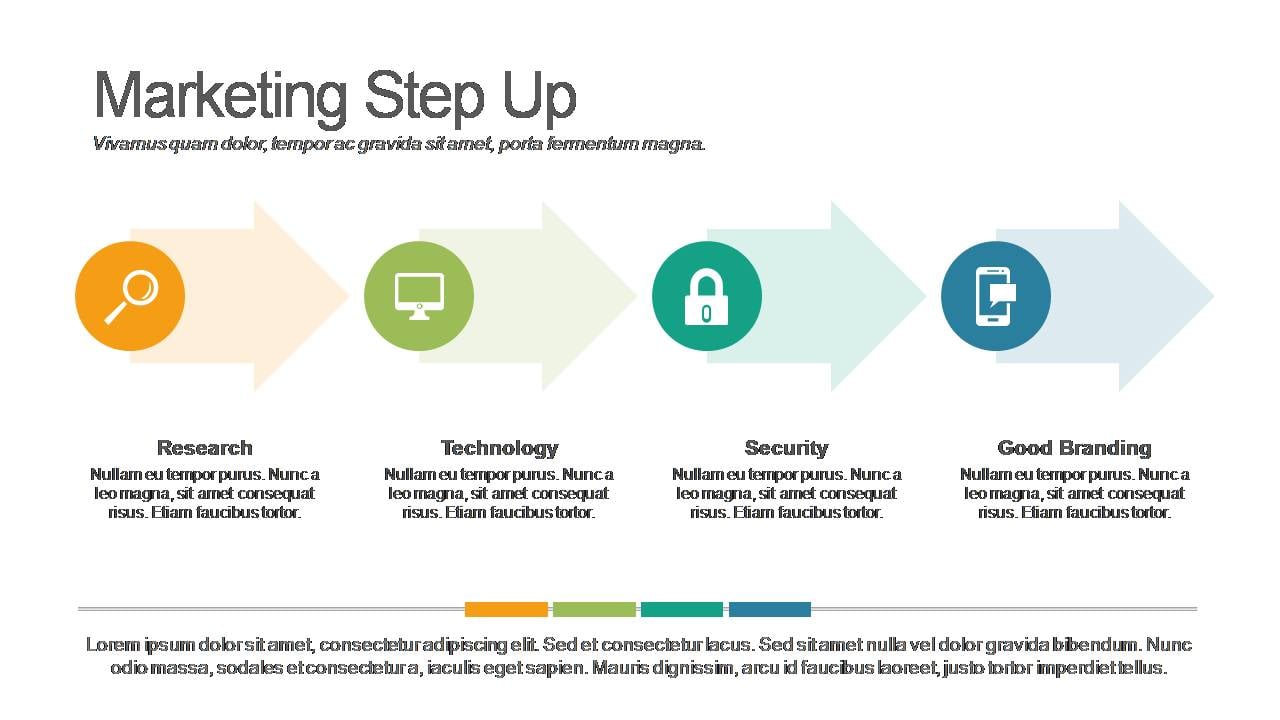

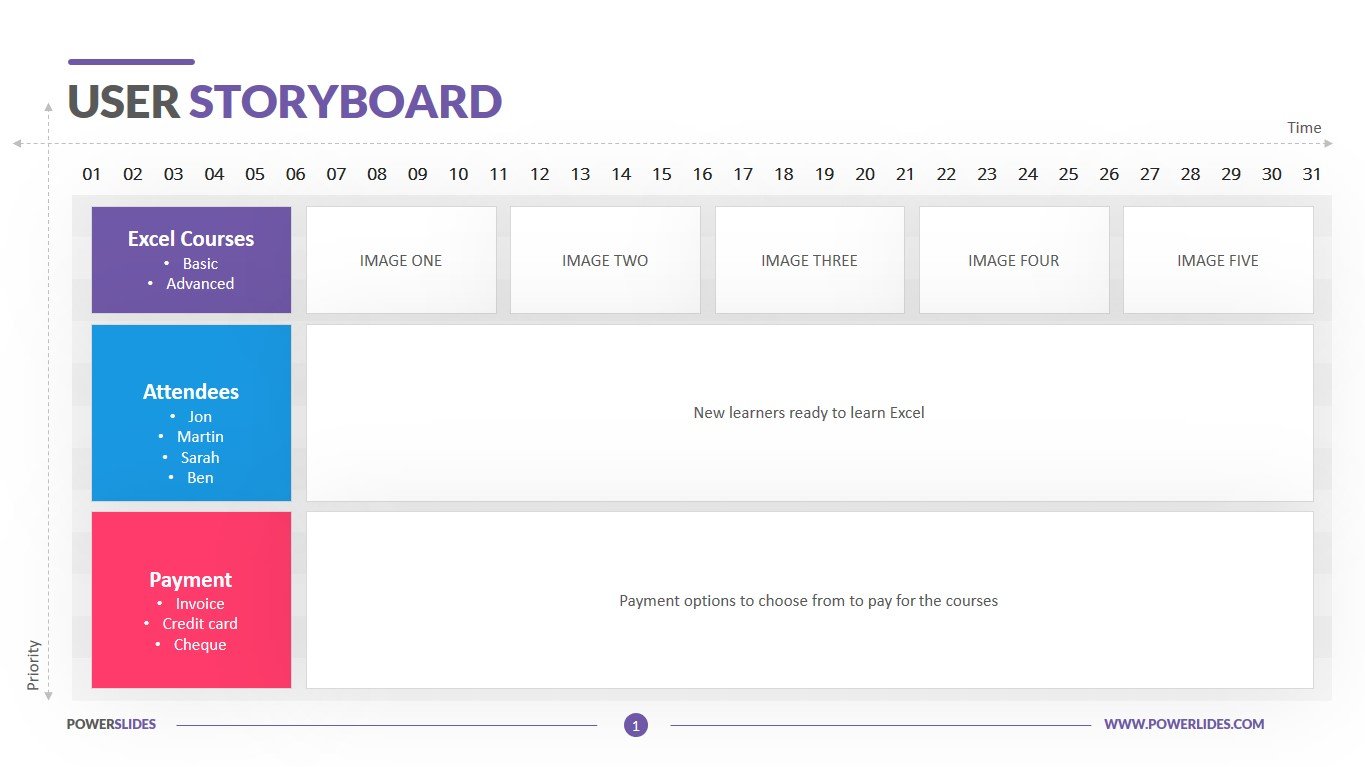

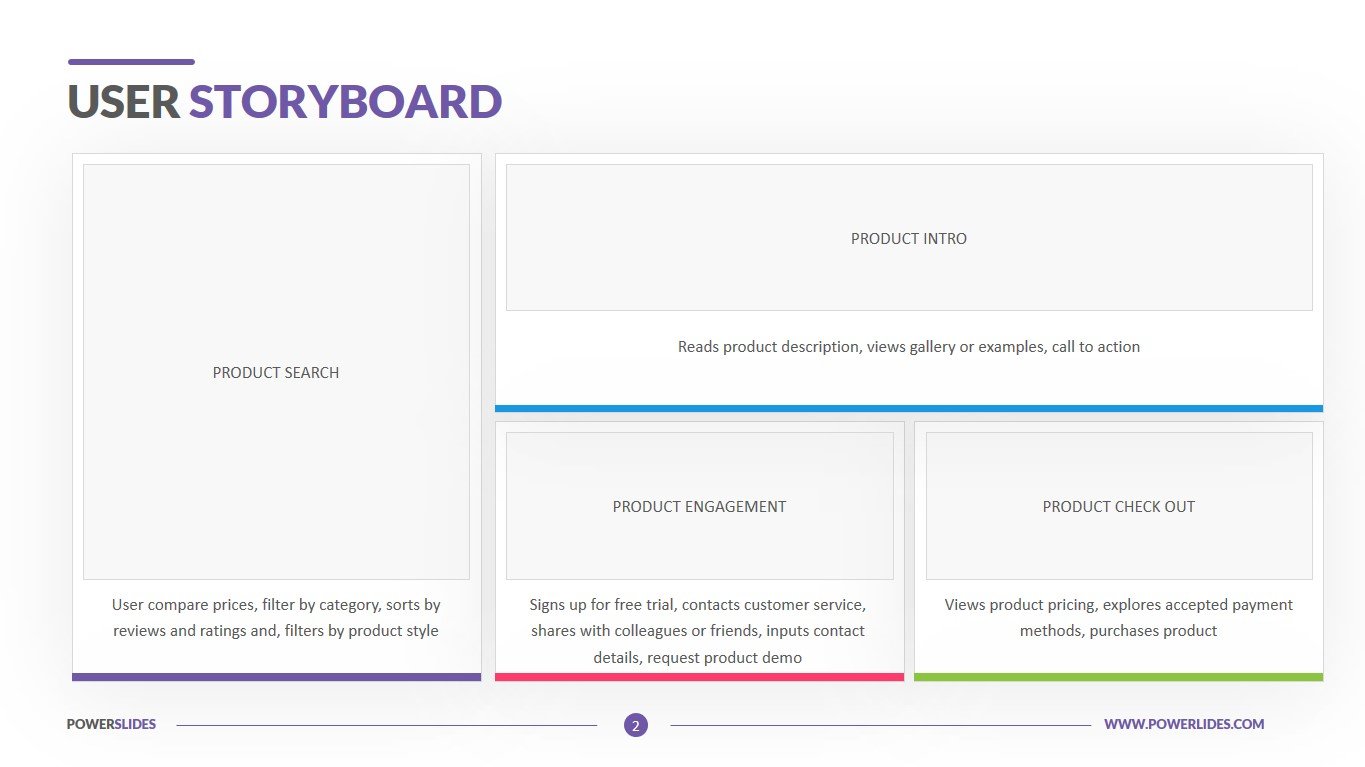

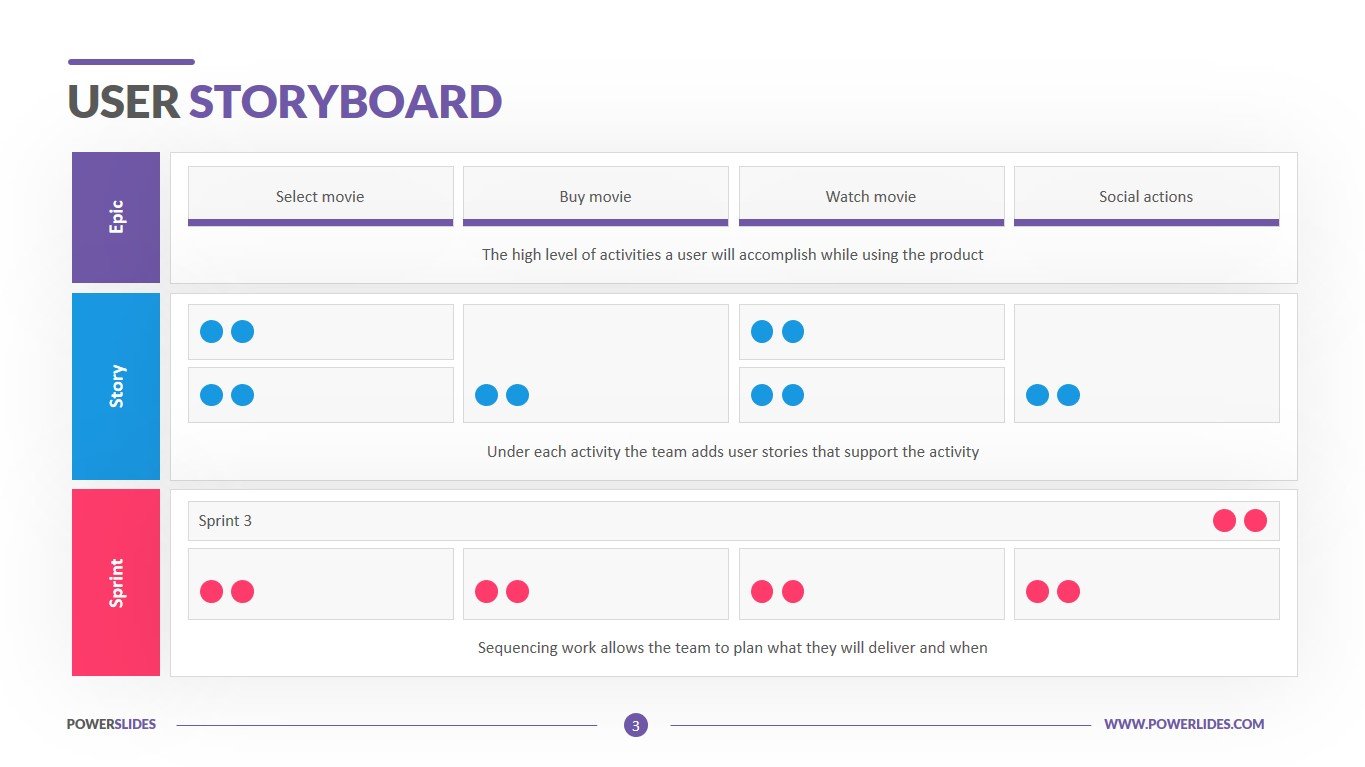

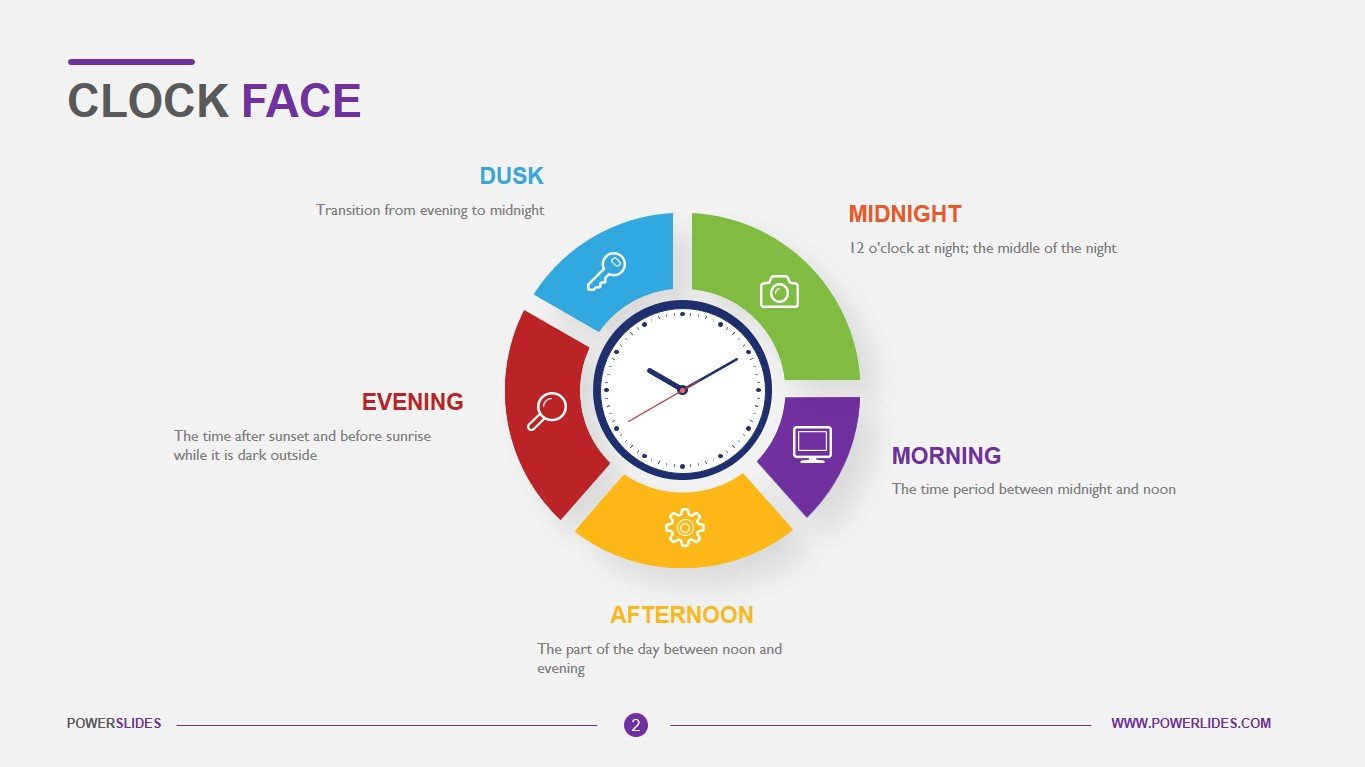

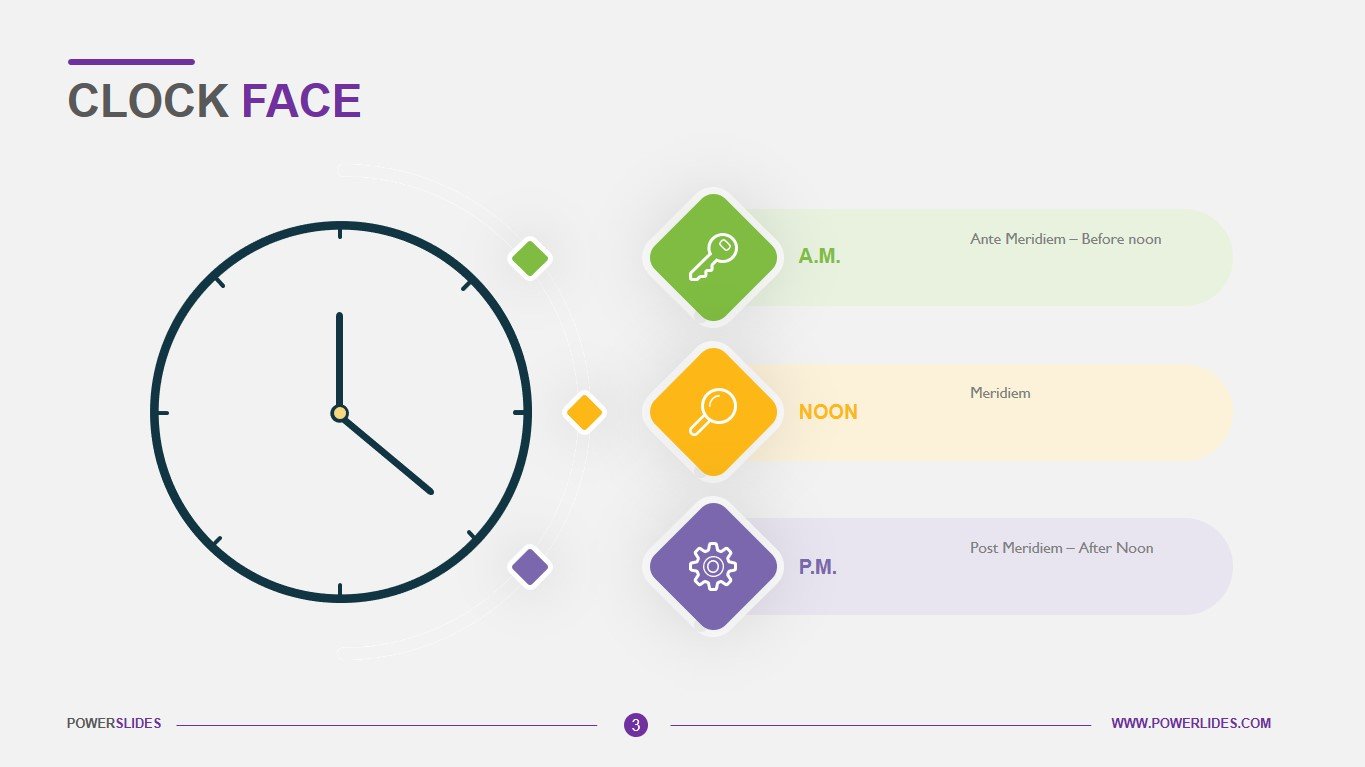

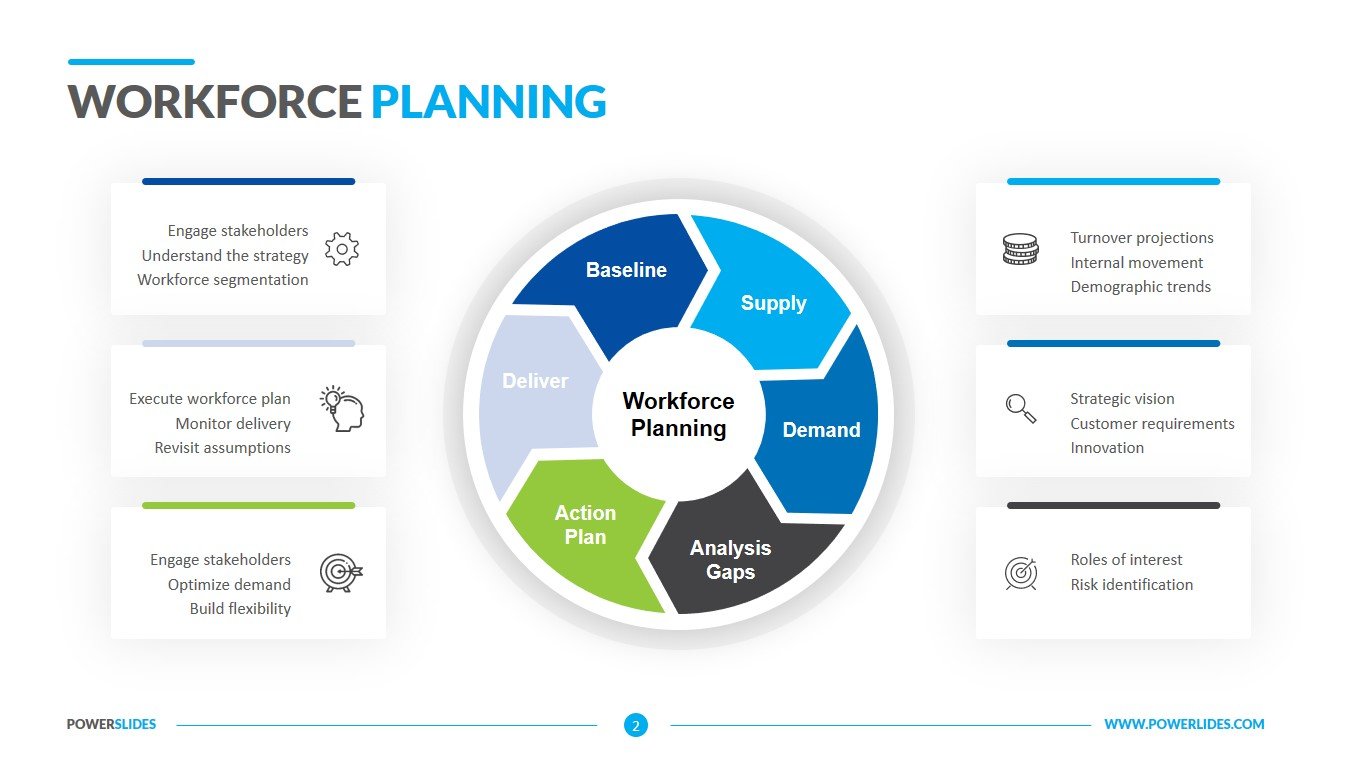

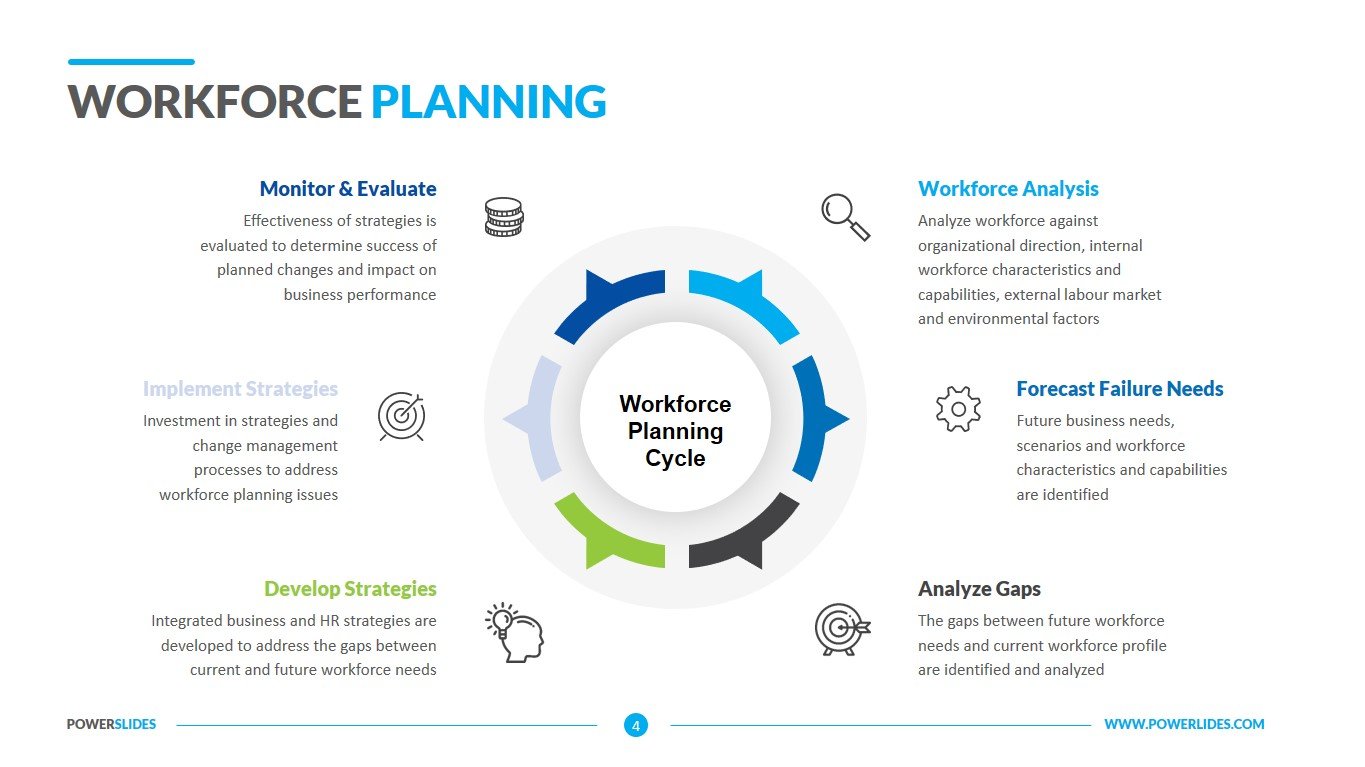

The Enterprise Risk Management Framework template consists of four slides that contain a huge number of different infographics. The first slide allows you to present your risk management system down to the smallest detail. You can describe the risks of a legal nature that may arise when legislation changes. You can also indicate the risks associated with changes in industry standards. This slide will primarily be useful to specialists from investment companies and financial institutions. Finance leaders can use this template to build financing models for a variety of investment options. Also, the slides of this template will be useful for startups in preparation for meeting with investors. Financial analysts can use the slides in this template when preparing a monthly stock forecast. The Enterprise Risk Management Framework template will be useful for insurance companies when preparing the calculation of the main coefficients for insurance benefits. All slide elements can be easily changed to suit your corporate requirements. Also, this template will be useful for crisis managers and development directors.

(3.50/ 5)

(3.50/ 5)