Risk Reward Template

6 Slides

6 Slides

File size: 16:9

File size: 16:9

Fonts: Lato Black, Calibri

Fonts: Lato Black, Calibri

Supported version

PPT 2010, PPT 2013, PPT 2016

Supported version

PPT 2010, PPT 2013, PPT 2016

Product details

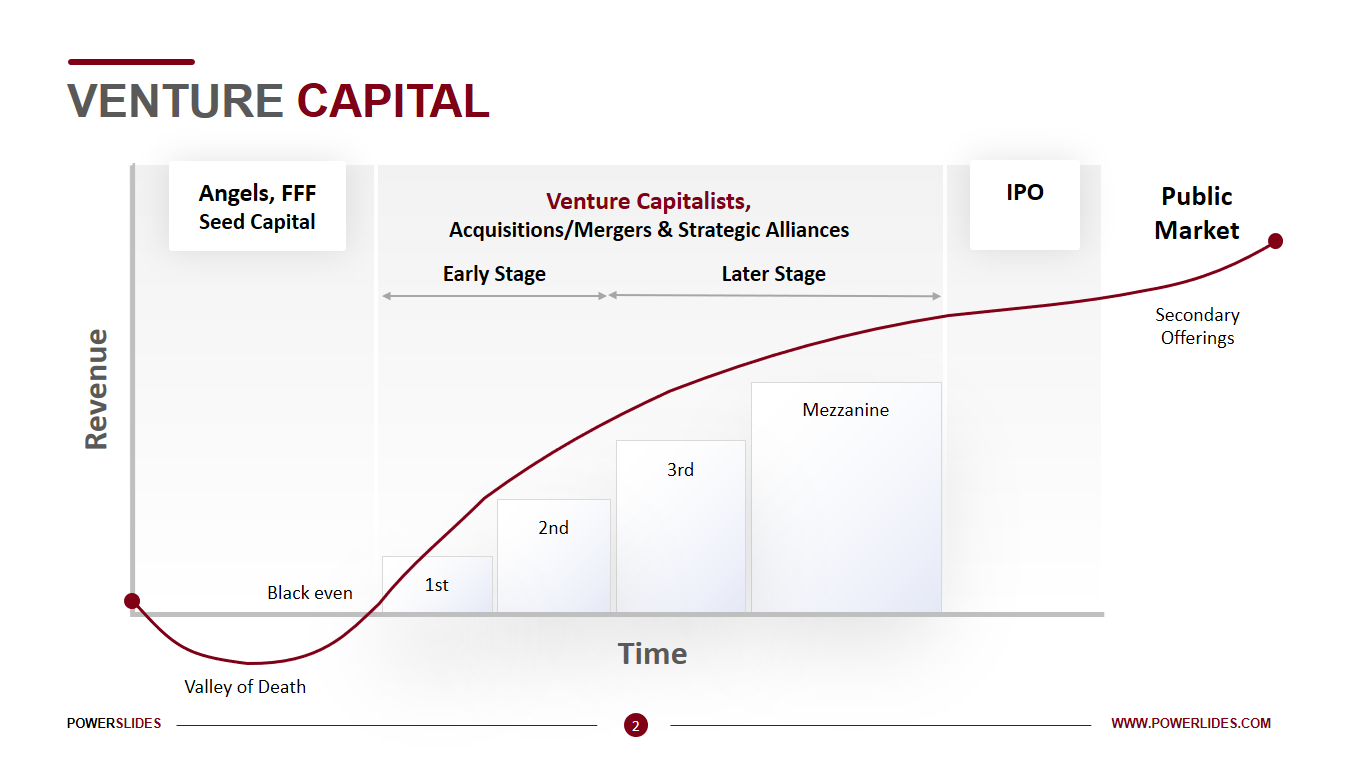

The risk reward ratio marks the prospective reward an investor can earn for every dollar they risk on an investment. Many investors use risk/reward ratios to compare the expected returns of an investment with the amount of risk they must undertake to earn these returns.

Traders often use this approach to plan which trades to take, and the ratio is calculated by dividing the amount a trader stands to lose if the price of an asset moves in an unexpected direction by the amount of profit the trader expects to have made when the position is closed.

In many cases, market strategists find the ideal risk/reward ratio for their investments to be approximately three units of expected return for every one unit of additional risk. Investors can manage risk/reward more directly through the use of stop-loss orders and derivatives such as put options.

The risk/reward ratio is often used as a measure when trading individual stocks. The optimal risk/reward ratio differs widely among various trading strategies.

Some trial-and-error methods are usually required to determine which ratio is best for a given trading strategy, and many investors have a pre-specified risk/reward ratio for their investments.

Investors often use stop-loss orders when trading individual stocks to help minimize losses and directly manage their investments with a risk/reward focus. A stop-loss order is a trading trigger placed on a stock that automates the selling of the stock from a portfolio if the stock reaches a specified low. Investors can automatically set stop-loss orders through brokerage accounts and typically do not require exorbitant additional trading costs.

Choosing the best risk/reward ratios is a balancing act between taking trades that offer more profit than risk while ensuring that the trade still has a reasonable chance of reaching the target before the stop loss.

The risk/reward ratio should not be the only measure you use to establish whether a trade is a good risk or not. It is often used with other risk-management ratios, such as the win/loss ratio or the break-even percentage.

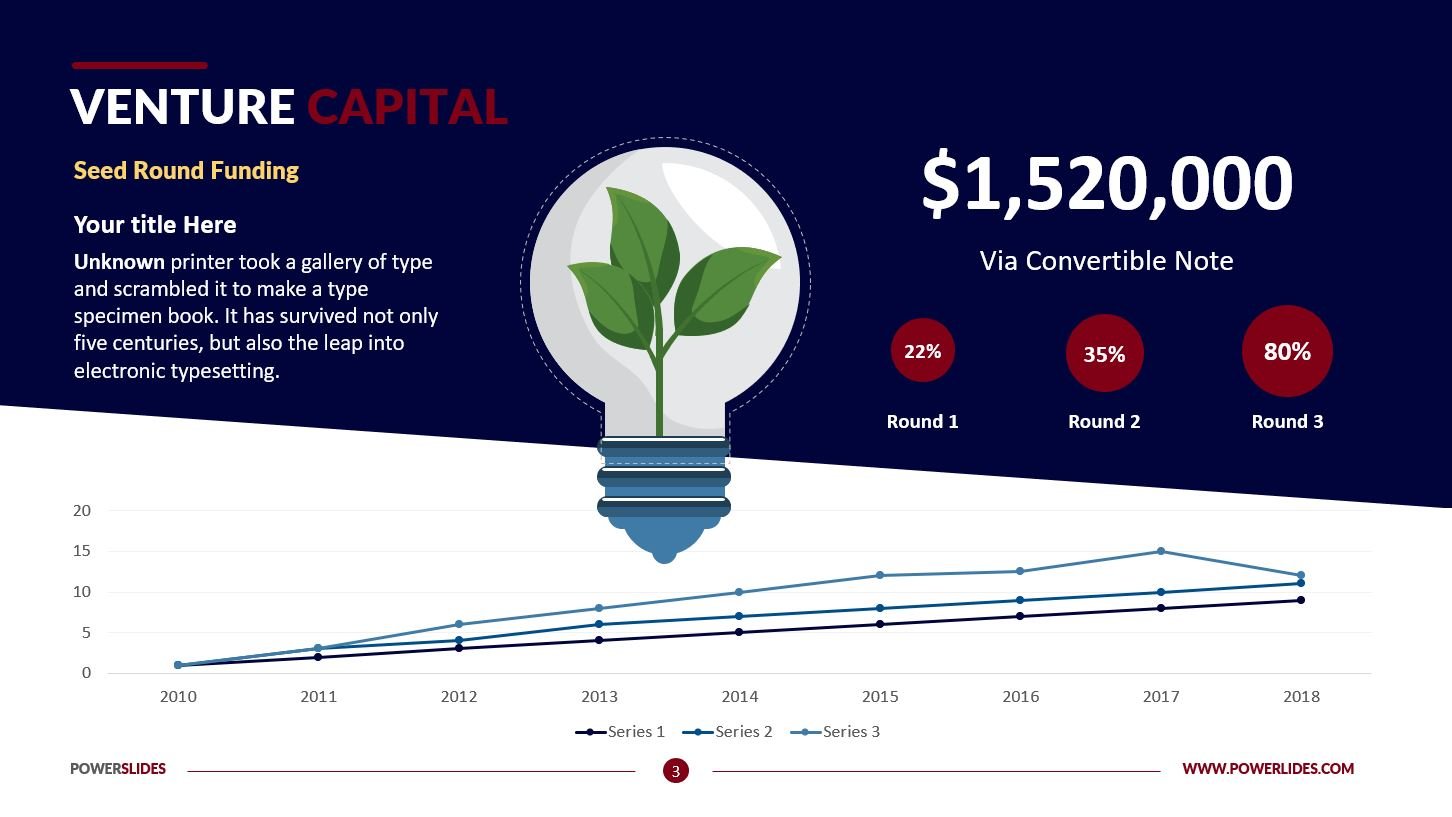

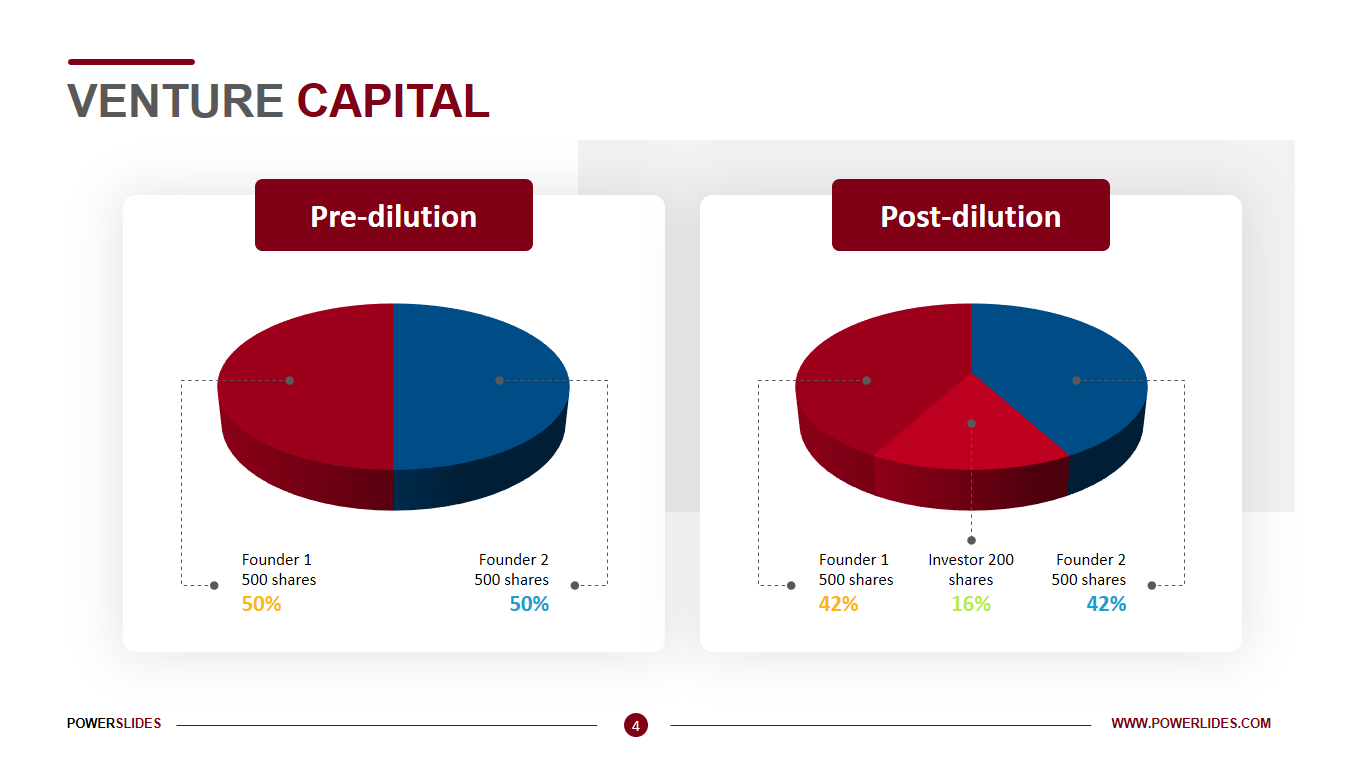

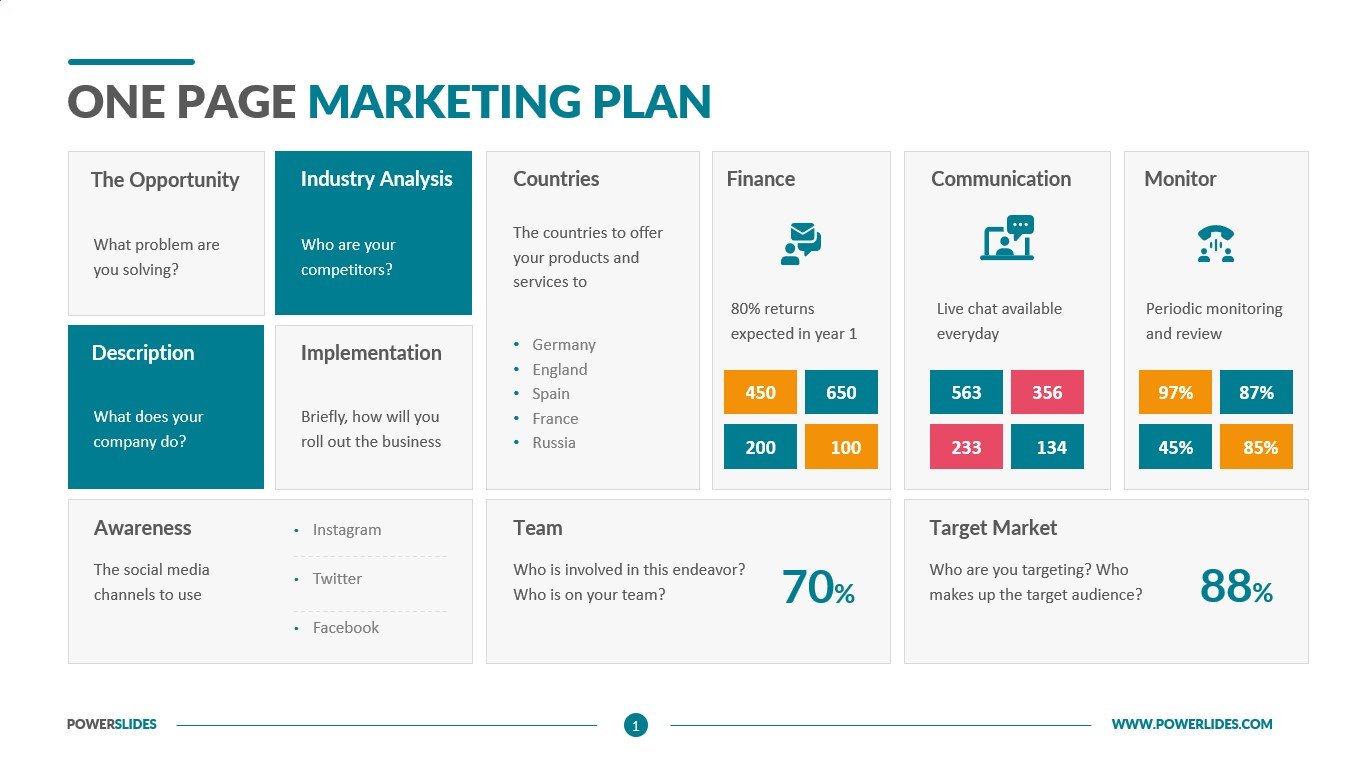

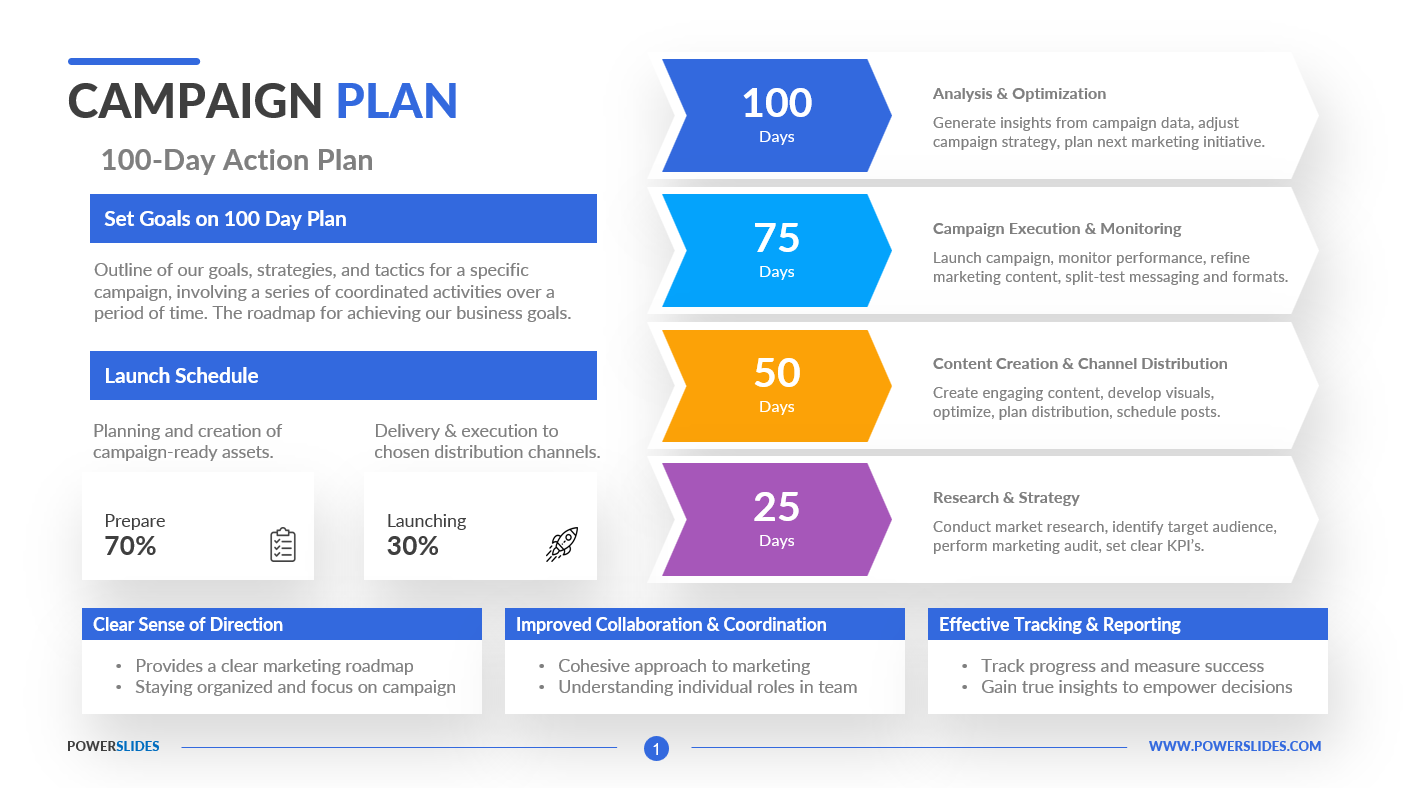

Startup executives can use the slides in this template when preparing for a meeting with potential investors. You can present an analysis of the profitability of your project for each invested monetary unit.

This template will be useful to economists and financiers when preparing reports on possible financial investments. You can describe in detail the possible profit from additional activities of the company.

This template will be useful for investment companies when preparing information on the profitability of stocks. You can describe in detail what profit it is possible to get when investing and what risks of non-repayment of funds may be.

Risk Reward is a professional and modern template that contains six stylish and fully editable slides. You can change the type and size of the font, color and position of the infographic yourself. This template will be useful for financiers, investment companies, startups and economists. Risk Reward template will complement your old presentations and will be a worthy addition to your collection of professional presentations.

(4.50/ 5)

(4.50/ 5)