Return on Investment

4 Slides

4 Slides

File size: 16:9

File size: 16:9

Fonts: Lato, Calibri

Fonts: Lato, Calibri

Supported version

PPT 2010, PPT 2013, PPT 2016

Supported version

PPT 2010, PPT 2013, PPT 2016

Product details

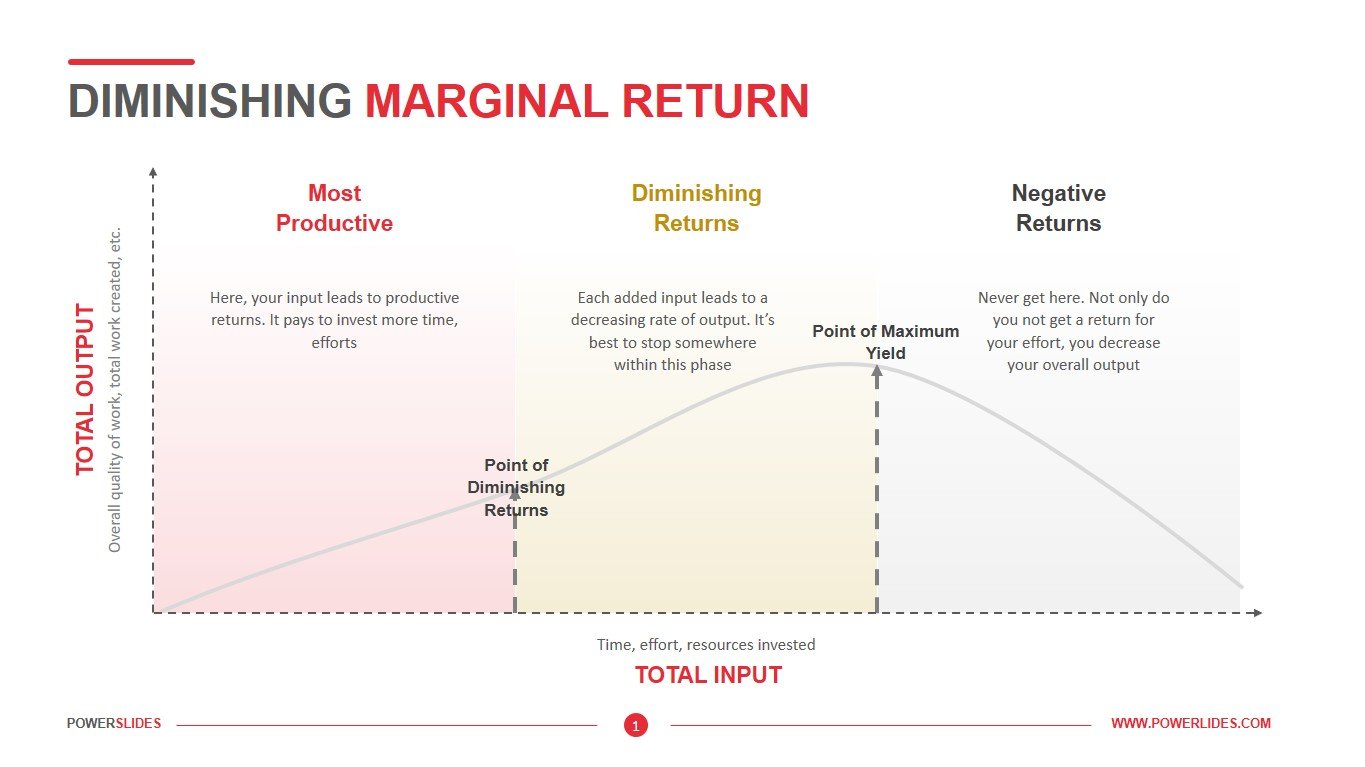

Return on investment is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. Return on investment tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.

To calculate Return on investment, the benefit or return of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio.

Current Value of Investment refers to the proceeds obtained from the sale of the investment of interest. Because Return on investment is measured as a percentage, it can be easily compared with returns from other investments, allowing one to measure a variety of types of investments against one another.

Return on investment is a popular metric because of its versatility and simplicity. Essentially, Return on investment can be used as a rudimentary gauge of an investment’s profitability. This could be the Return on investment on a stock investment, the Return on investment a company expects on expanding a factory, or the Return on investment generated in a real estate transaction.

The calculation itself is not too complicated, and it is relatively easy to interpret for its wide range of applications. If an investment’s Return on investment is net positive, it is probably worthwhile. But if other opportunities with higher Return on investments are available, these signals can help investors eliminate or select the best options. Likewise, investors should avoid negative Return on investments, which imply a net loss.

What qualifies as a “good” Return on Investment will depend on factors such as the risk tolerance of the investor and the time required for the investment to generate a return. All else being equal, investors who are more risk-averse will likely accept lower Return on Investments in exchange for taking less risk. Likewise, investments that take longer to pay off will generally require a higher Return on Investment in order to be attractive to investors.

Be in the know of the return on your investment. The return on investment template is a PowerPoint template for visualizing the return on investment using charts and infographics.

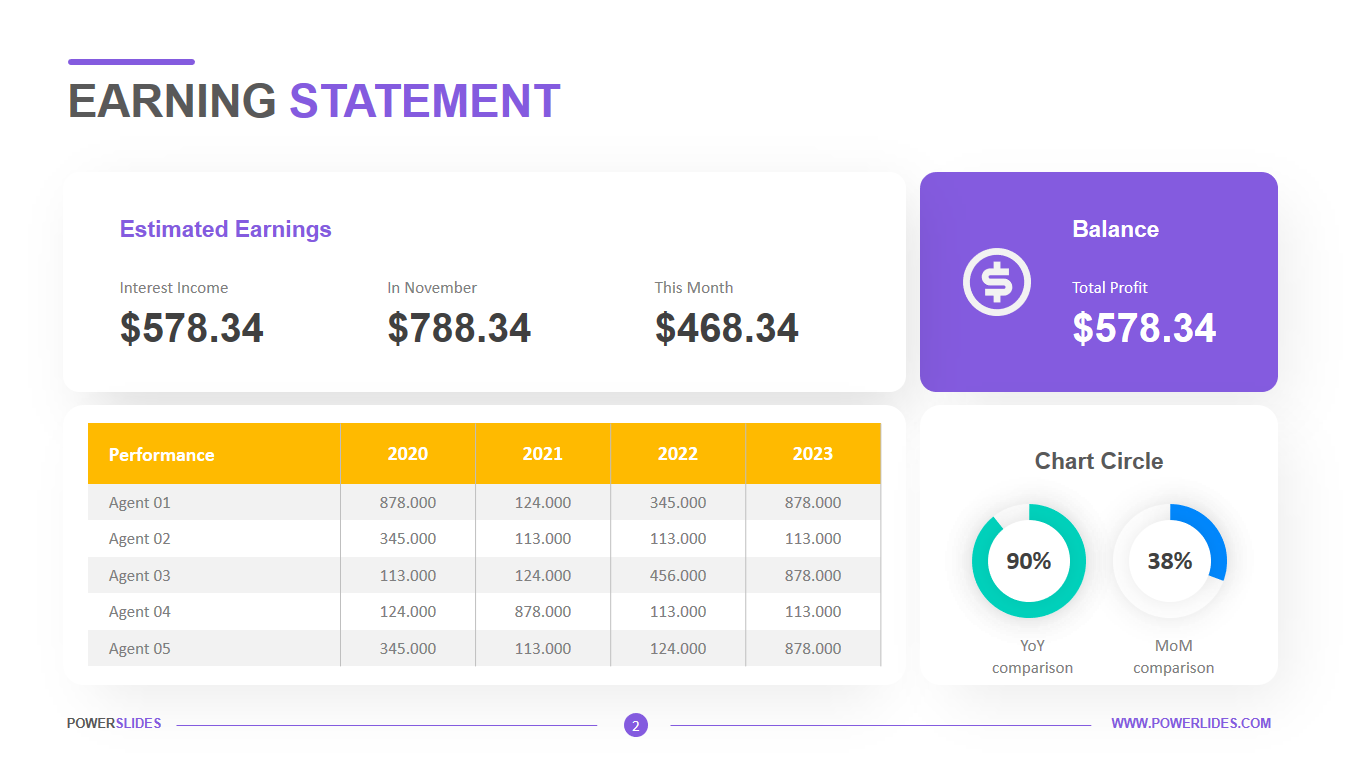

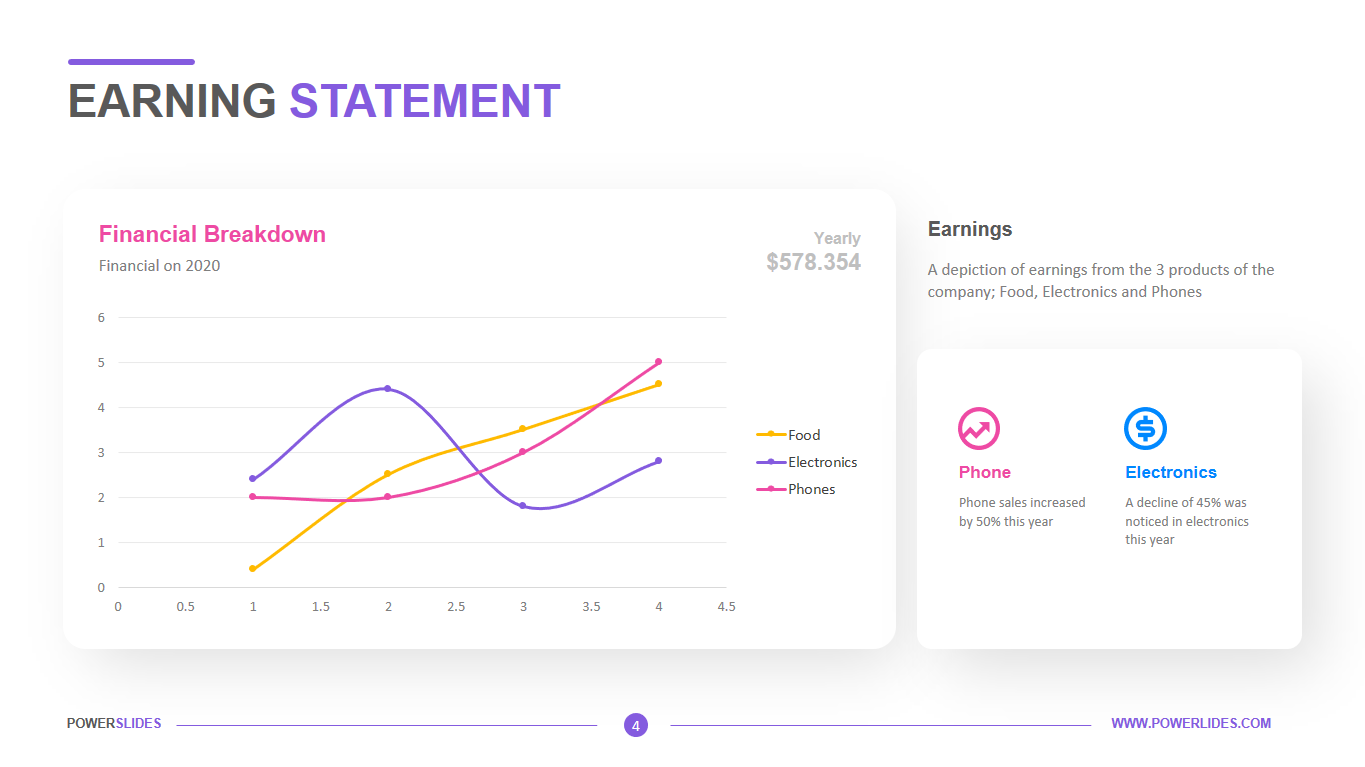

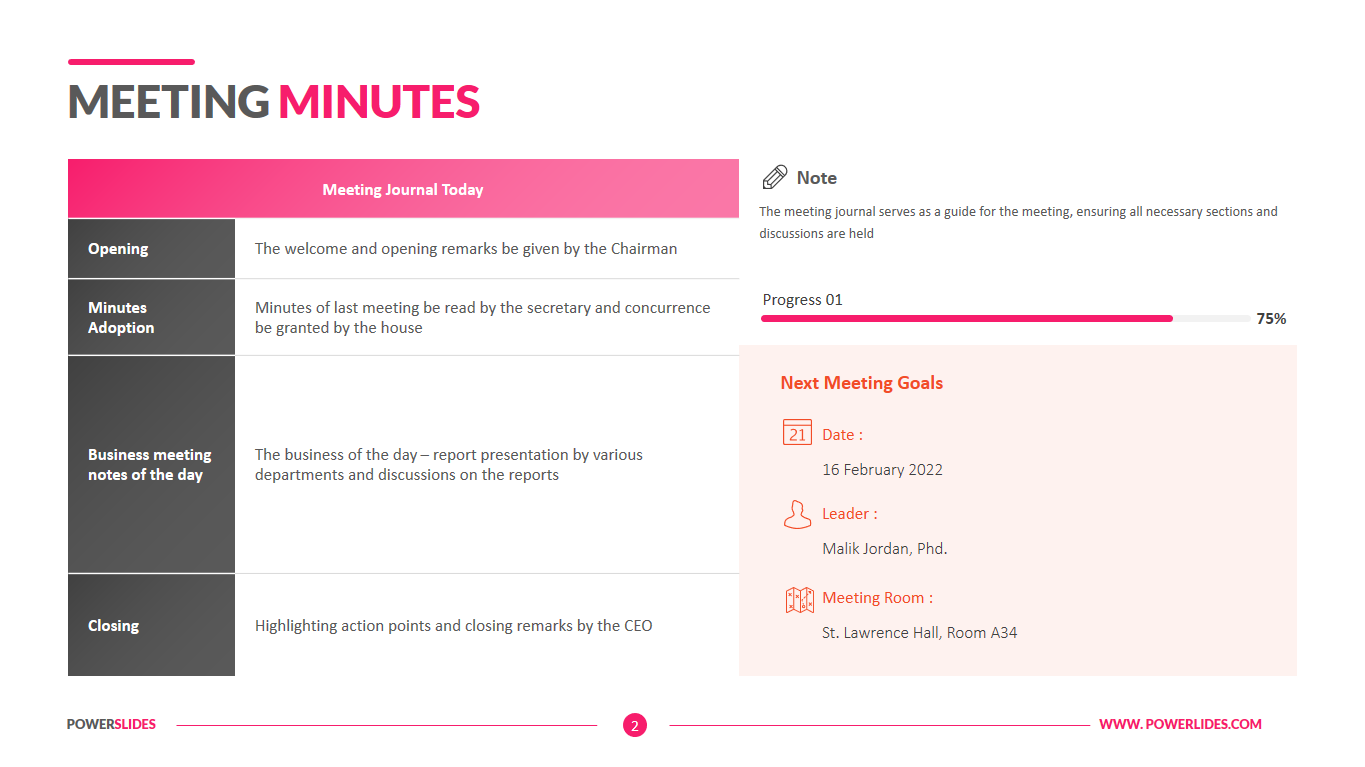

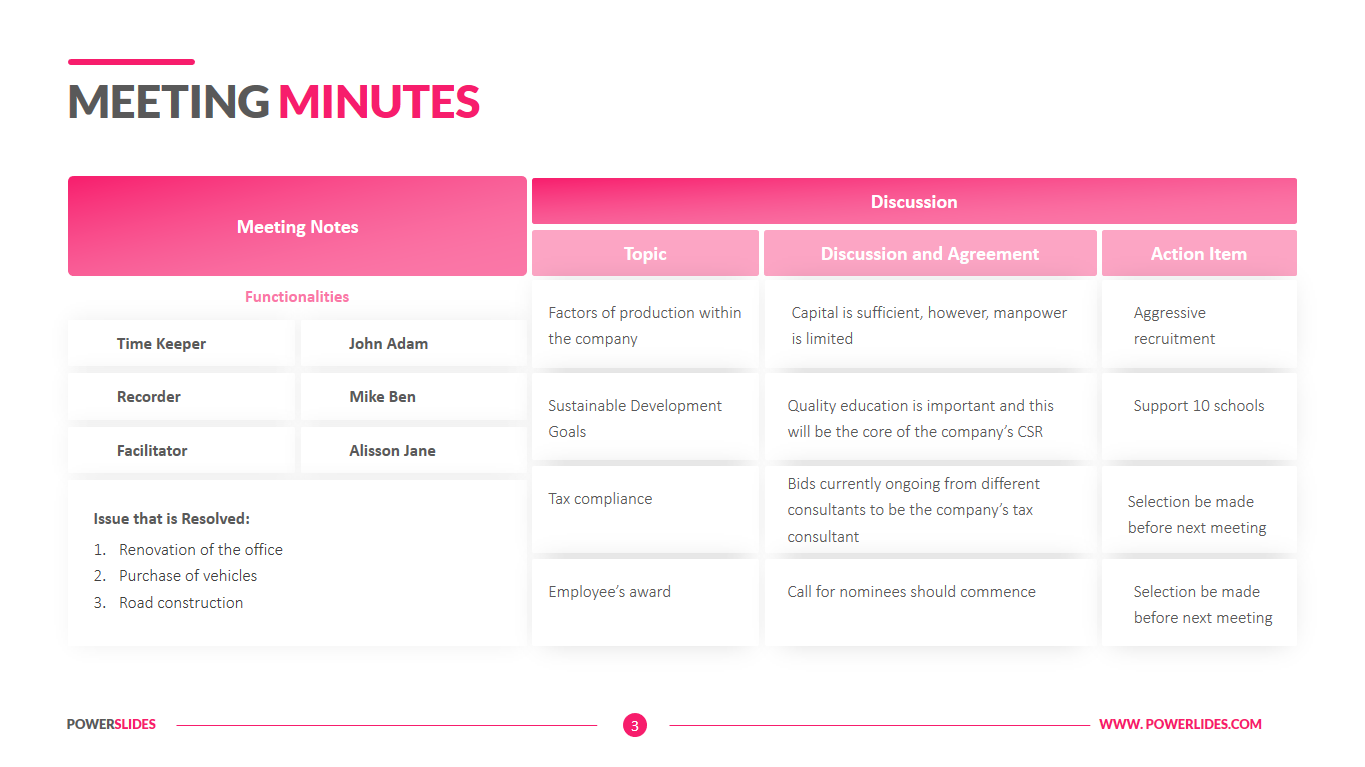

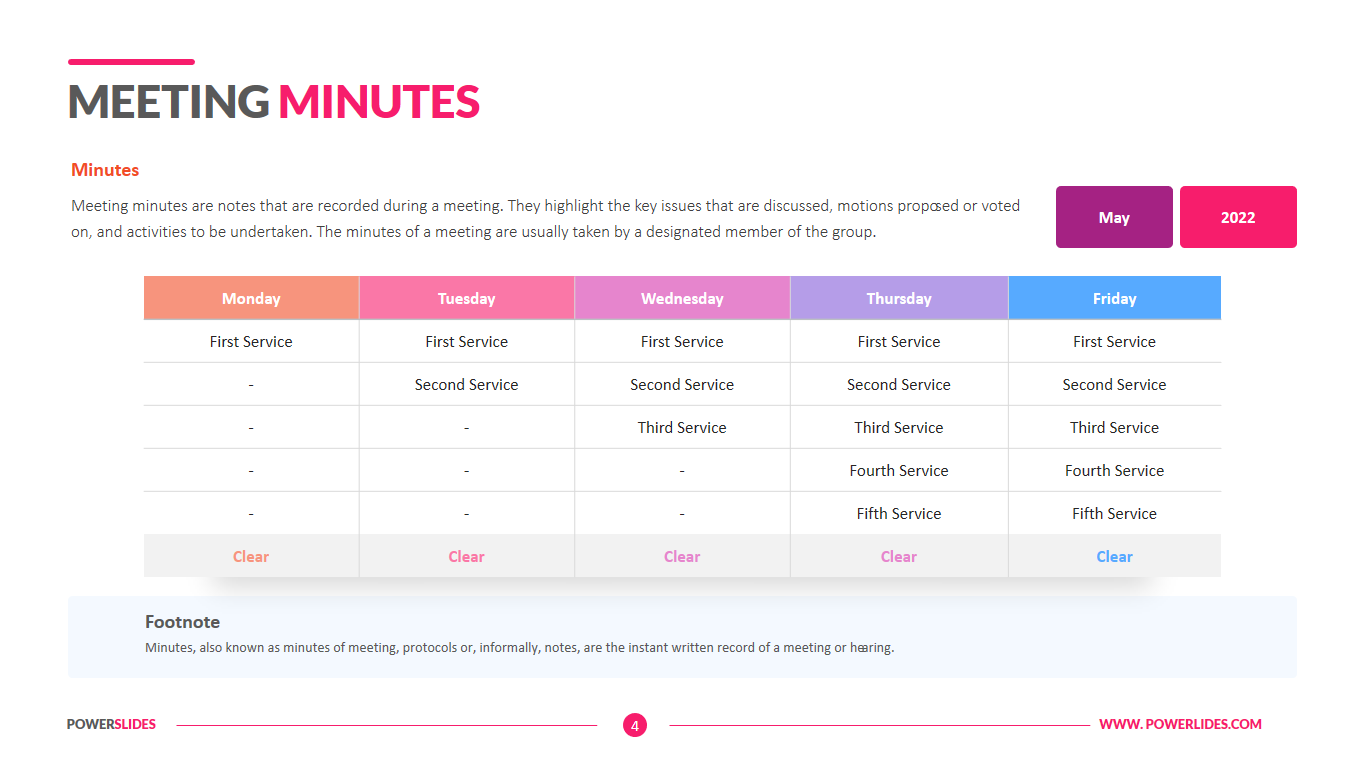

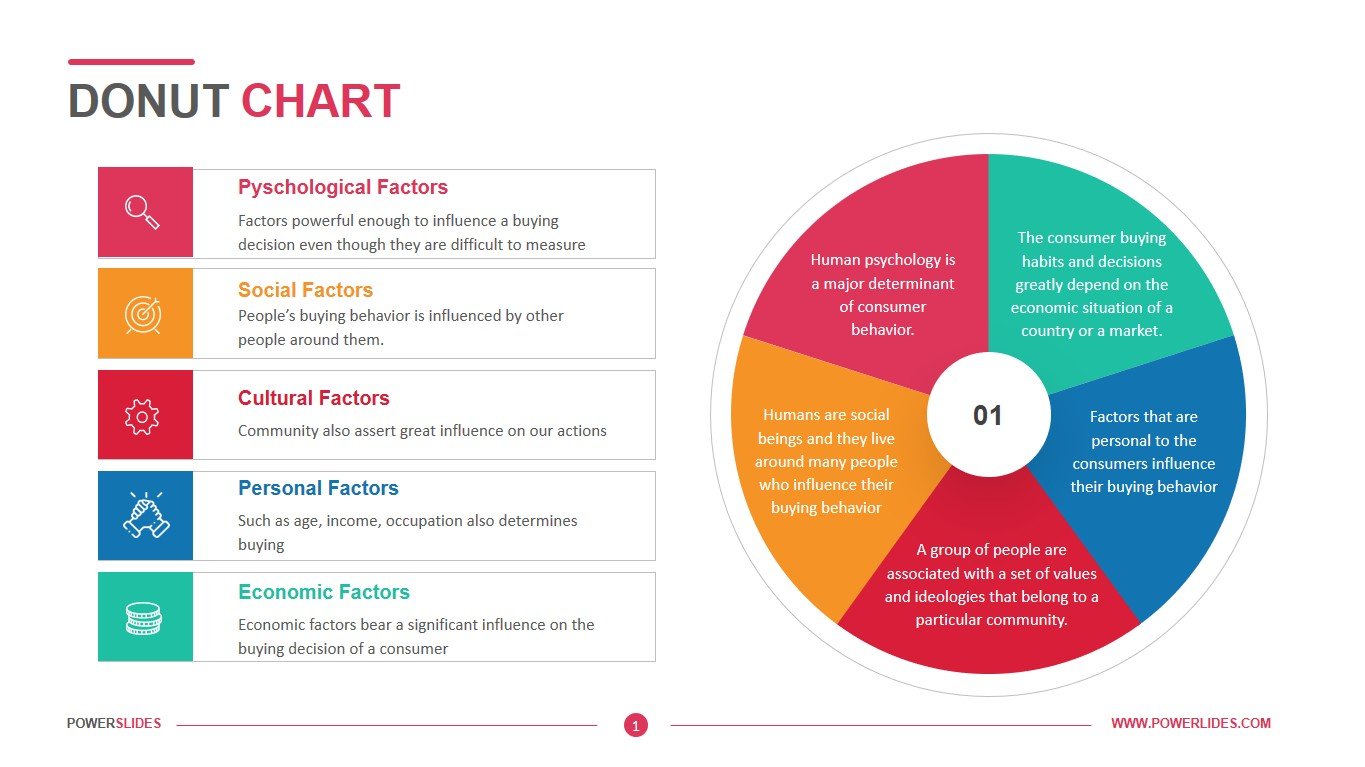

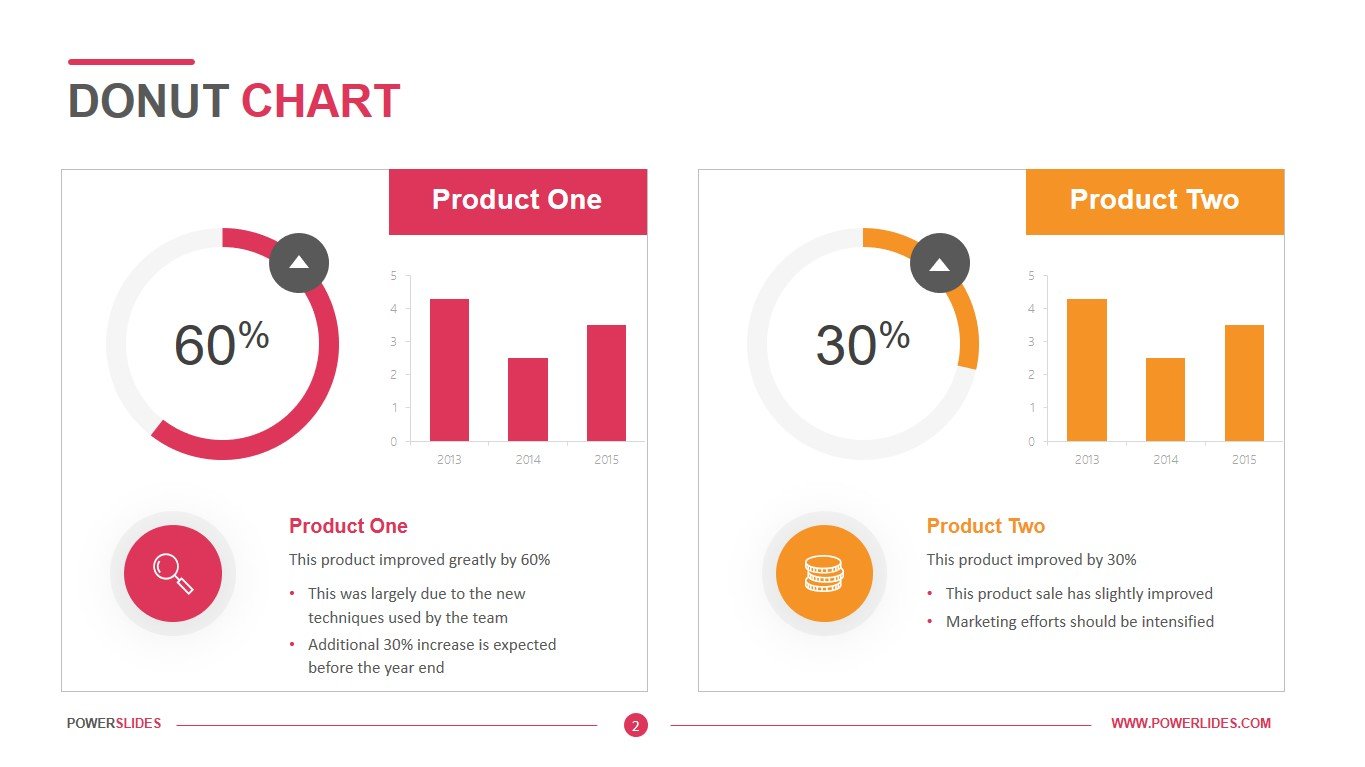

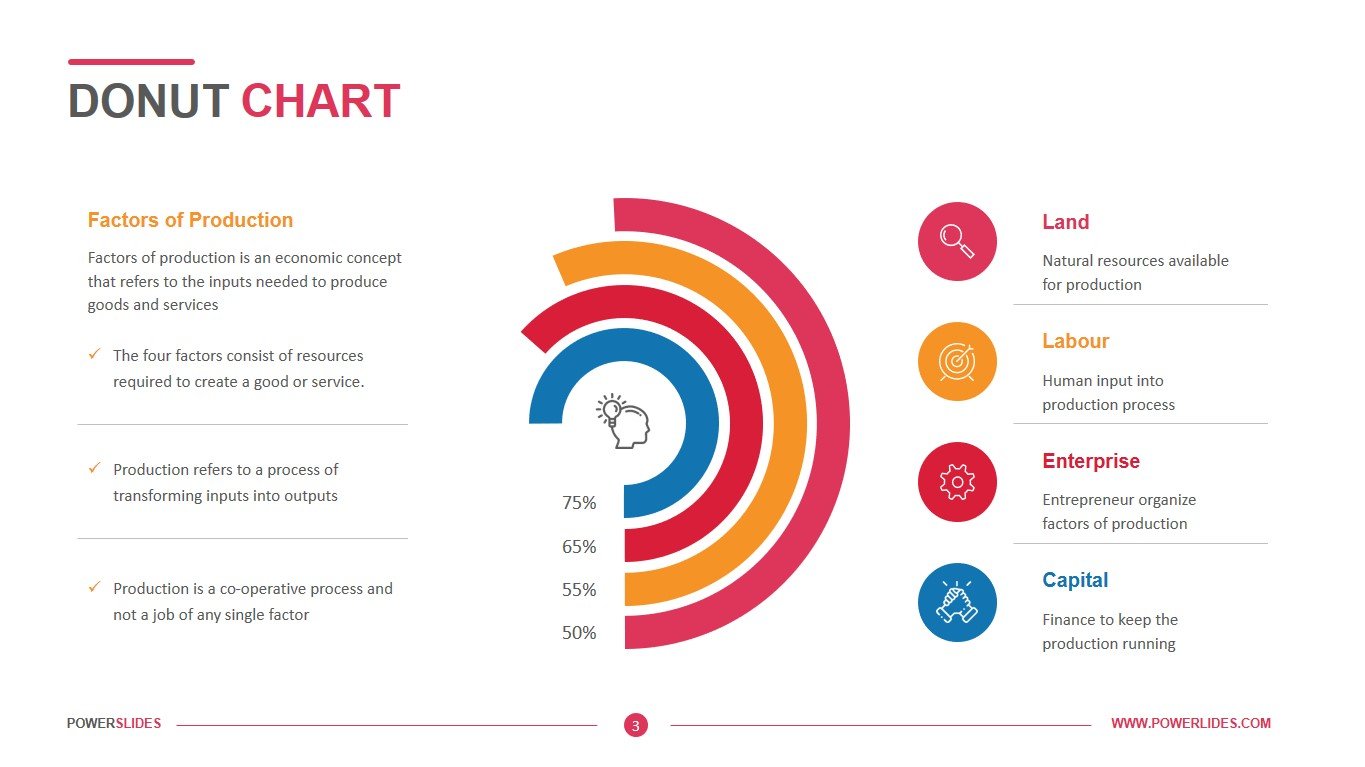

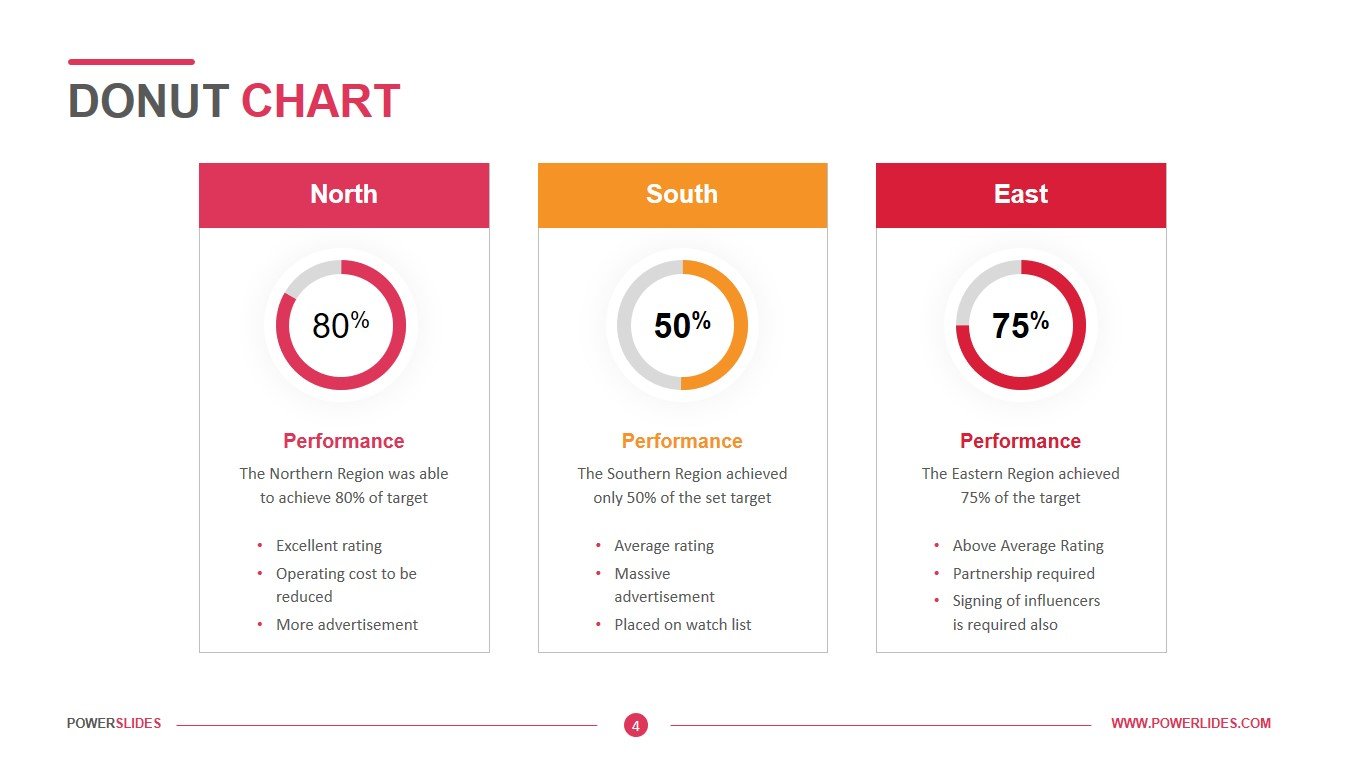

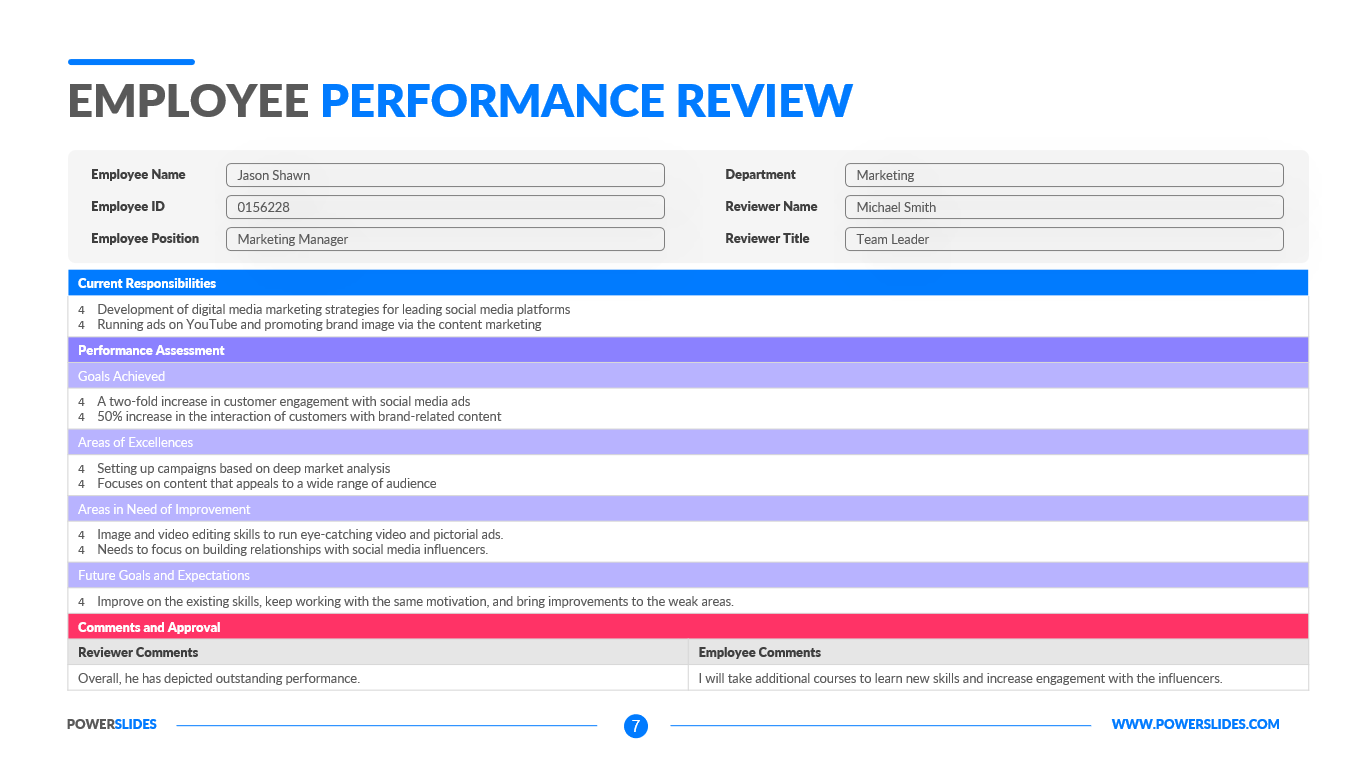

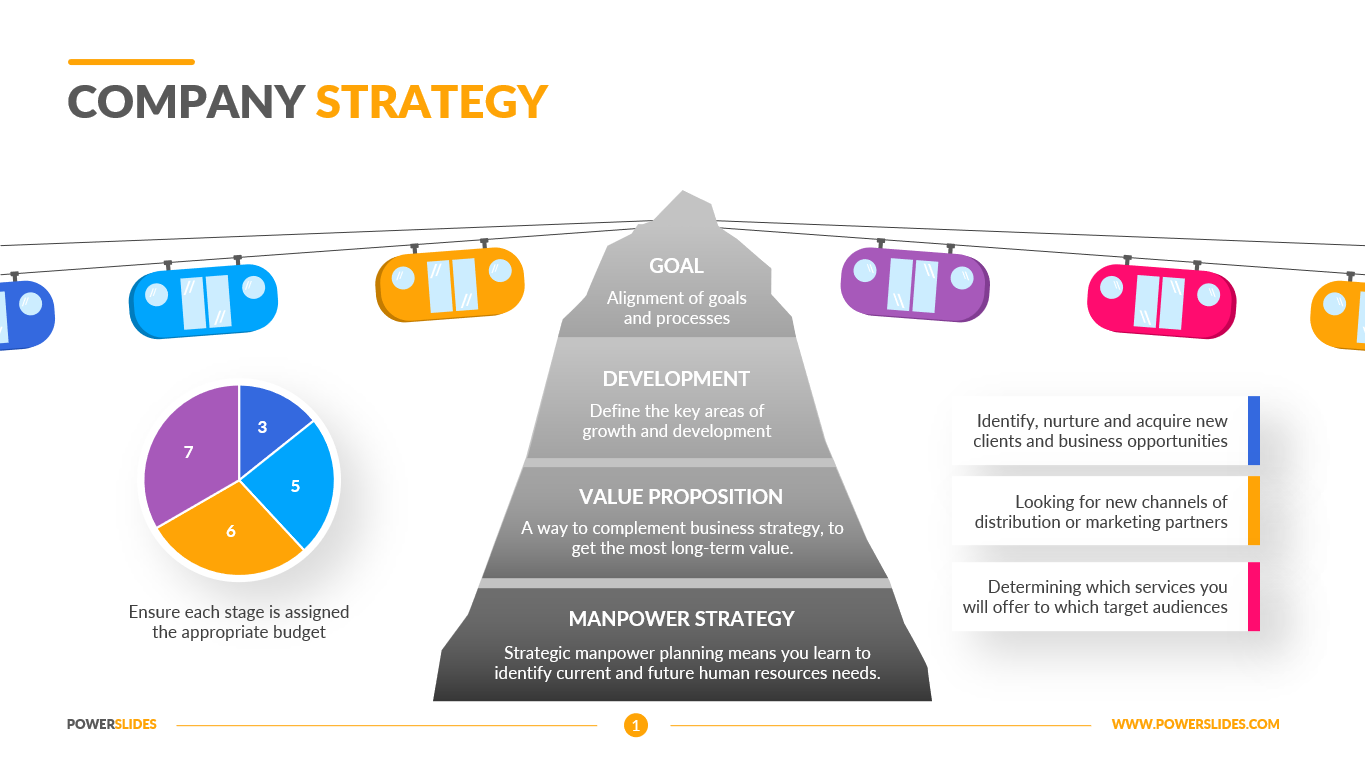

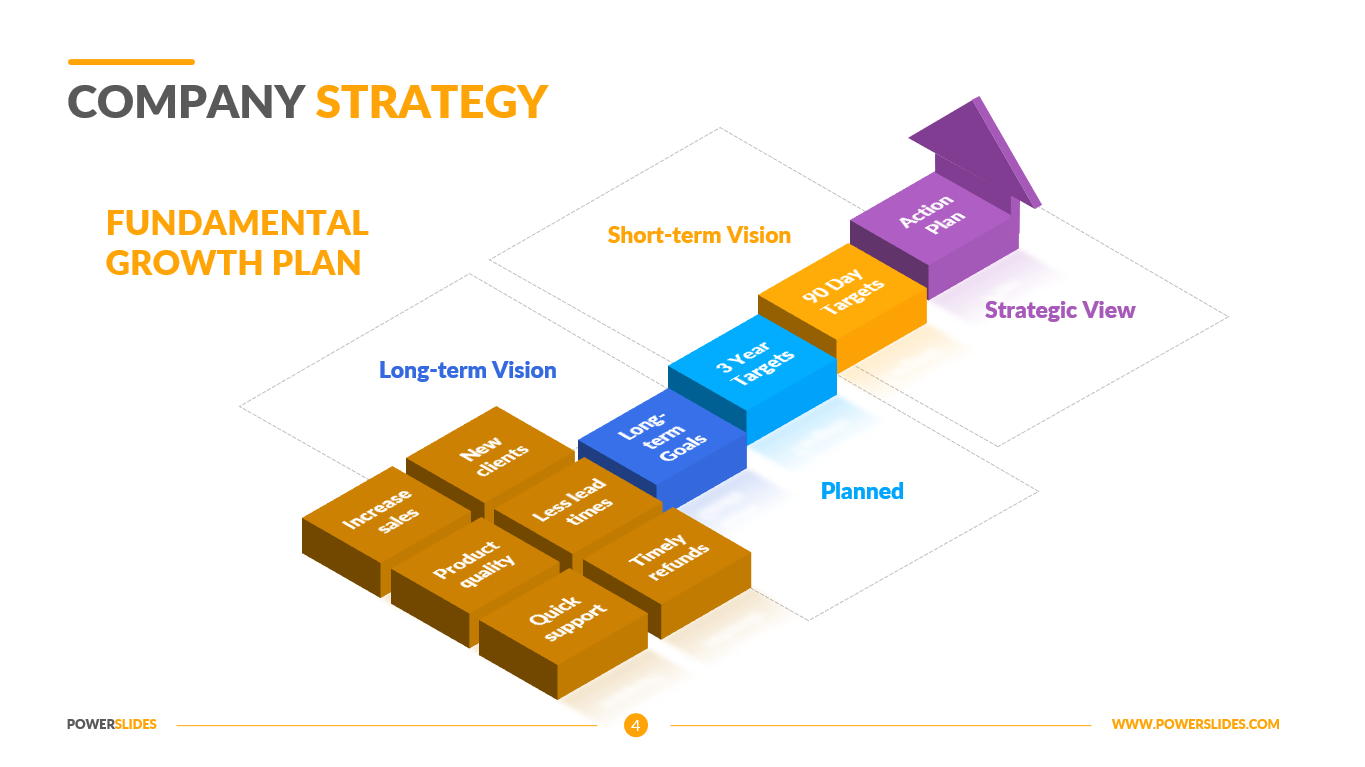

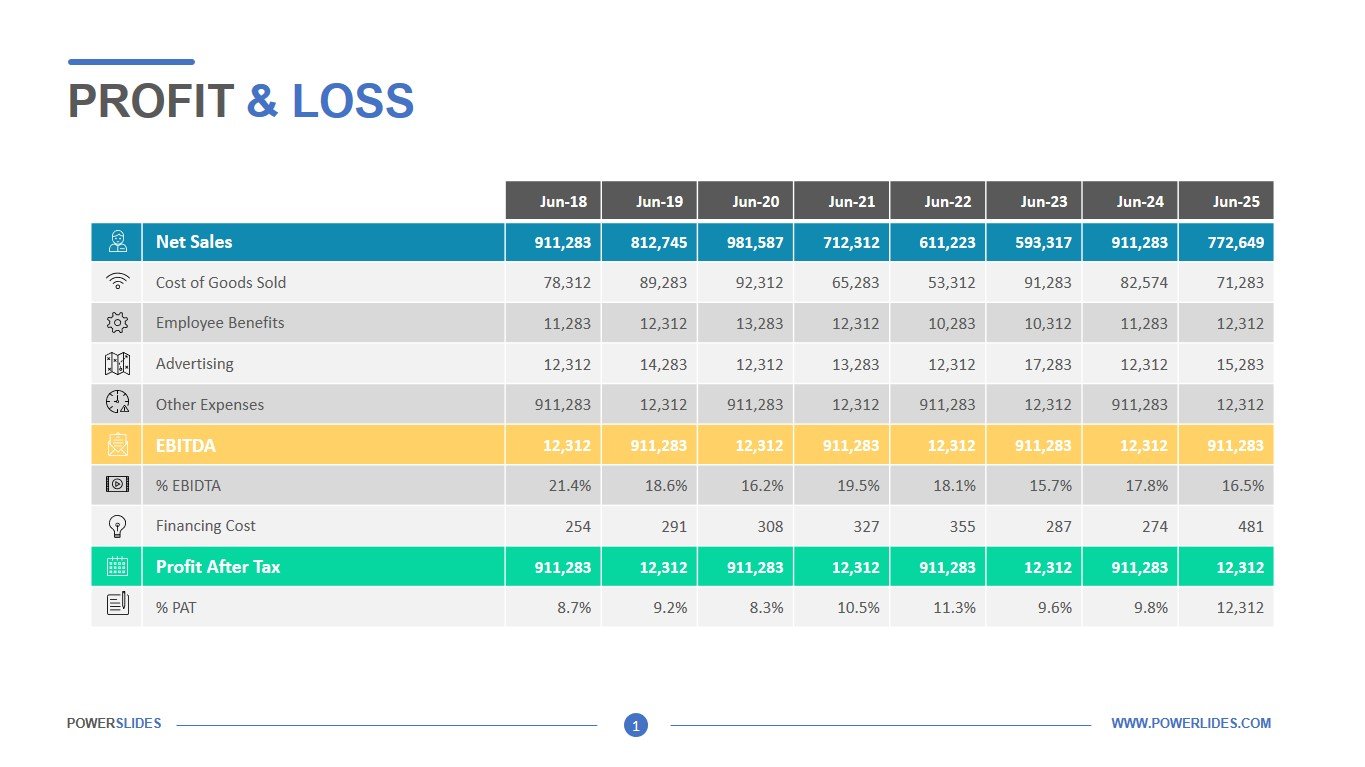

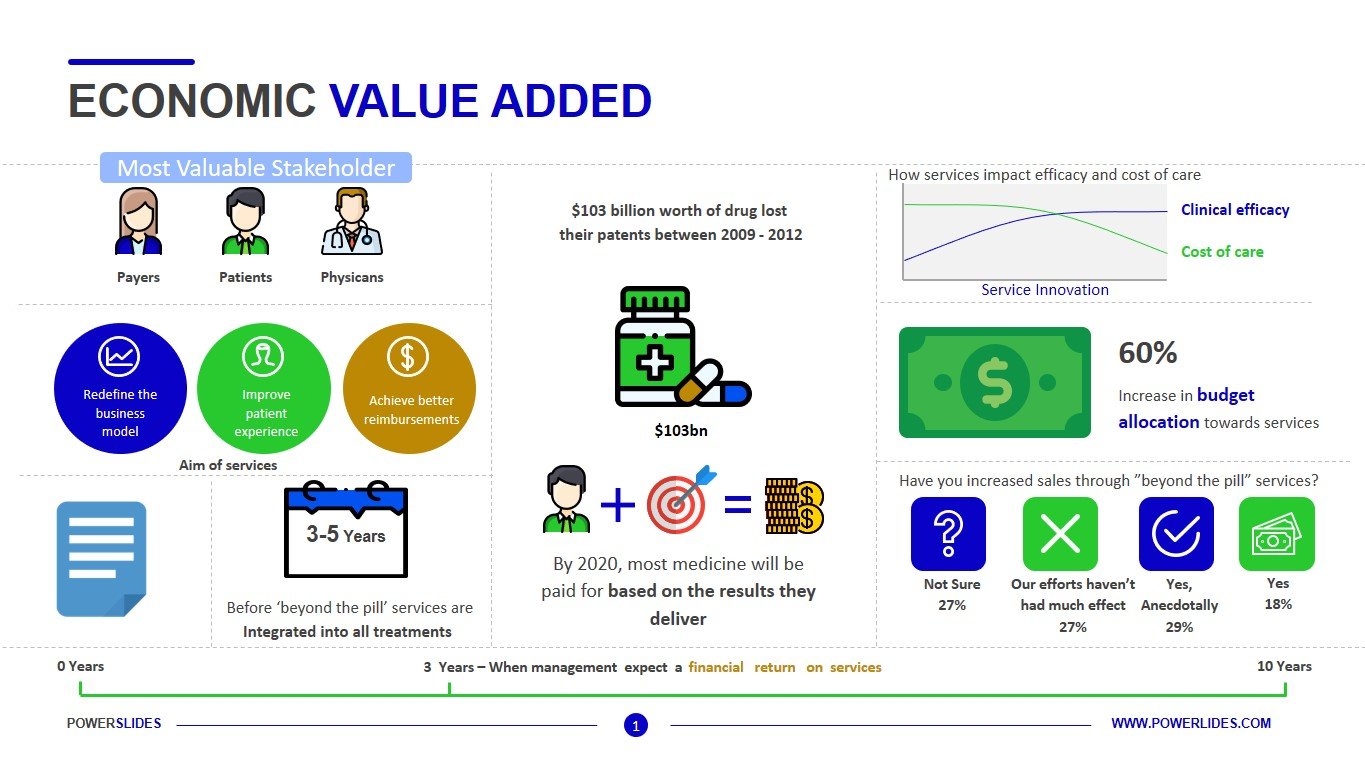

The ROI template contains 4 slides with impressive layout and graphics for engaging your audience. In the first slide, the weigh balance icon with cost and benefit weights on either side is a metaphor of cost-benefit analysis that is carried out before an investment is made. The opposite arrows let the audience know that both financial and non-financial costs and benefits are considered during the analysis. The table chart in the second slide allows the user to highlights RIO data and compare their costs and benefits. Subsequent slides allow the user to present the investment sum and the returns on the investment.

This template will be useful for startups when preparing to meet with potential investors. You can prepare information about the payback period of your startup and reaching the break-even point. Investment companies can also use this template when preparing an analysis of companies that can be invested in. You can prepare several slides for each company and on the last one make a comparative analysis of the payback of projects for each company.

Also, this template will be useful for heads of companies when preparing for a meeting with shareholders and providing them with a new strategy for the development of the company. Engineers can use the slides in this template to report on the need to retool old production lines and provide a timeline for project payback. Economists and financial analysts can also use this template in their day to day work.

The template is fully editable and customizable to meet user requirements. The ROI template is widely used in businesses before investment decisions are taken.

(4.67/ 5)

(4.67/ 5)